The Middle East’s healthcare build-out is creating massive demand. But without the right technology partner, hospitals struggle to equip new facilities effectively and on time, slowing down crucial projects.

The Middle East’s healthcare build-out is turning plans into purchasing lists. Success requires matching demand for PACS reading rooms, 4K ORs, and high-resolution screening displays with a tender-ready approach and a portfolio that scales from clinical seats to advanced hubs.

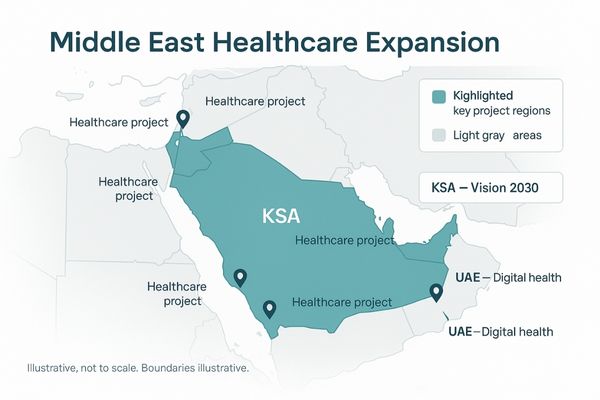

The region’s shift from strategic planning to active implementation is creating tangible procurement opportunities. National initiatives like Vision 20301 are no longer just abstract goals; they are driving budgets for specialty centers, digital health platforms, and widespread infrastructure upgrades. For medical display vendors, this means the conversation has moved from potential to purchase orders. The key is understanding that new facilities must be equipped from the ground up, while existing hospitals are simultaneously undergoing modernization. This dual demand requires a versatile and compliant portfolio. Success hinges on providing solutions that meet the rigorous standards for calibrated, standards-compliant reading rooms2 that scale across PACS networks. A general-purpose diagnostic monitor like the MD33G is essential for these environments, offering the reliability and image consistency needed for daily clinical review. Vendors who can address these foundational needs while also providing advanced solutions for surgery and mammography will be best positioned to win.

GCC build-out: OR & PACS demand

GCC nations are investing heavily to add hospital capacity under Vision 2030. Yet, this expansion often outpaces the deployment of the specialized visualization tools needed to make them truly effective.

Hospital expansion across the GCC is fueling parallel demand for both high-resolution PACS reading rooms and 4K surgical displays. Aligning product portfolios with these modernization programs is critical for success.

The ambitious national transformation plans across the Gulf Cooperation Council (GCC), particularly Saudi Arabia’s Vision 2030 and the UAE’s strategic healthcare goals, are the primary engine for market growth. This is not merely about constructing new buildings; it is a fundamental effort to modernize care pathways and elevate the standard of clinical practice. This modernization directly translates into specific technology requirements. For radiology departments, it means establishing calibrated reading rooms equipped for high-volume PACS workflows. For operating theaters, the focus is on adopting minimally invasive techniques, which depend entirely on superior visualization. As a result, demand is surging for both diagnostic and surgical displays. To align with these program milestones, it is essential to offer a portfolio that covers high-resolution PACS seats3 for radiologists and advanced 4K surgical displays for surgeons. A dual-screen diagnostic monitor like the MD46C fits perfectly into these modernized reading rooms, providing the large, seamless digital canvas required for efficient comparison of medical images.

KSA procurement: the NUPCO gate

Entering the public hospital market in the Kingdom of Saudi Arabia presents a significant hurdle. Vendors unfamiliar with the centralized procurement process face long delays and frequent rejection.

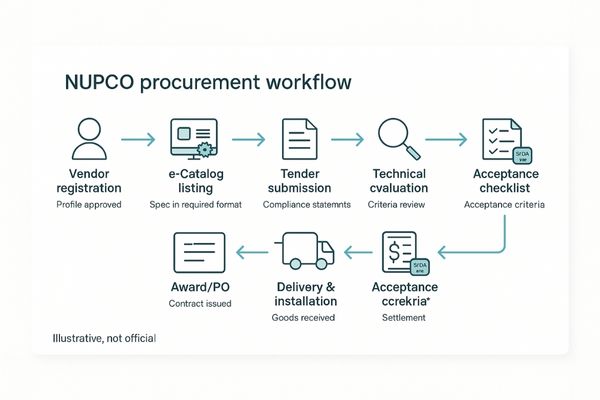

NUPCO’s unified e-catalog is the mandatory entry path for devices in KSA public hospitals. Vendors who arrive "tender-ready" with complete documentation materially improve win rates and shorten procurement cycles.

For public hospitals in the Kingdom of Saudi Arabia, the National Unified Procurement Company (NUPCO)4 governs the entire source-to-pay process. This centralized system defines the exclusive entry path for all medical devices, and navigating it successfully requires preparation and precision. NUPCO’s unified e-catalog standardizes how products are specified, tendered, and purchased, creating a highly structured but challenging environment for new vendors. Simply having a compliant product is not enough. Success depends on being "tender-ready5," which means providing a complete package of documentation from the outset. This includes detailed specification templates that match NUPCO’s required format, clear compliance statements for all relevant standards, and predefined acceptance checklists for post-delivery verification. By preparing these materials in advance for products like the versatile MD26C diagnostic monitor, vendors can de-risk the procurement journey for their local partners, materially improve win rates, and significantly shorten the cycle from tender submission to final award.

UAE digital health & teleradiology

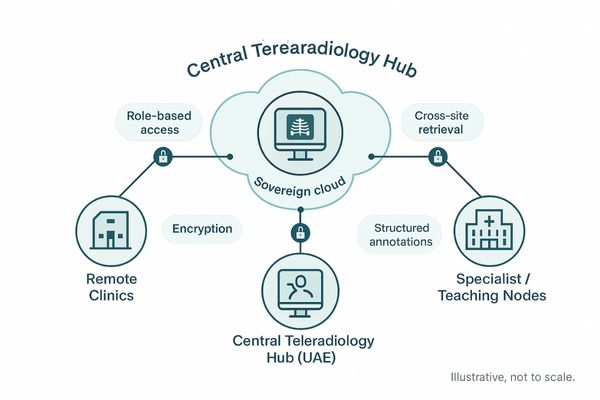

The UAE’s push for digital transformation creates demand for connected health solutions. However, integrating disparate imaging systems for remote collaboration remains a significant technical challenge for many institutions.

The UAE’s digital health strategy favors standards-compliant, multi-window displays for remote reads and cross-site collaboration. Teleradiology hubs benefit from high-pixel workflows that reduce switching costs and improve turnaround times.

The United Arab Emirates, particularly through Abu Dhabi’s Department of Health (DoH) initiatives, has placed AI, sovereign cloud, and seamless data integration at the heart of its healthcare strategy. This national vision directly influences technology choices within its healthcare facilities. The emphasis on connectivity and remote services creates a strong preference for medical displays that are not only standards-compliant but also optimized for multi-source visualization. For the growing number of teleradiology hubs6, efficiency is paramount. A radiologist needs to view images from multiple sites, access patient history from the EMR, and consult with referring physicians without toggling between different screens or applications. This is where large, single-screen workflows provide a distinct advantage. A 12MP monitor7 like the MD120C allows for a high-pixel-density layout, reducing the "switching cost" associated with managing multiple windows and ultimately improving diagnostic turnaround times. This aligns perfectly with the UAE’s goal of creating a responsive, interconnected healthcare ecosystem.

Screening drives 5–12MP adoption

National screening programs are effective at early detection but generate enormous image volumes. This data deluge can overwhelm radiology departments using outdated or lower-resolution display technology.

Population screening programs for breast cancer are structurally increasing demand for 5MP and 12MP monitors. Positioning a 5MP foundation with a 12MP lead reader balances capacity with diagnostic confidence.

Large-scale public health initiatives, such as Qatar’s PHCC “Screen for Life” program, are making routine breast screening a standard part of preventative care across the region. While invaluable for patient outcomes, these programs structurally increase the demand for specialized mammography reading environments. The adoption of Digital Breast Tomosynthesis (DBT)8 further amplifies this need, as it produces large, complex datasets that require high-resolution displays for accurate interpretation. Consequently, the market has seen a definitive shift toward 5MP and 12MP monitors9. A typical workflow involves using 5MP grayscale monitors, like the MD52G, for foundational reading capacity across the department. For lead radiologists or those handling the most complex cases and DBT studies, a single 12MP fusion display becomes the primary workstation. This "hub-and-spoke" model allows healthcare providers to balance cost-effective capacity with the highest level of diagnostic confidence, ensuring that screening programs can operate efficiently without compromising clinical quality.

OR upgrades: 4K and 12G-SDI

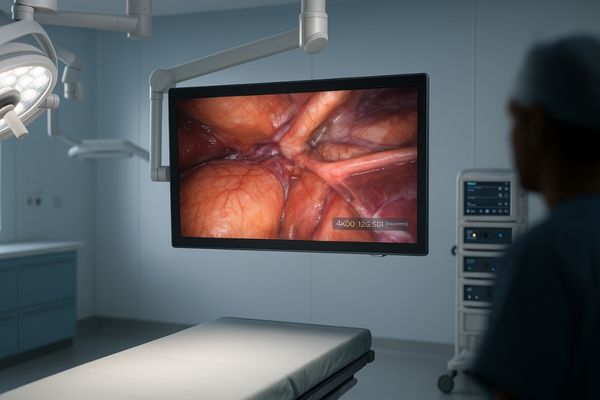

As surgeons adopt minimally invasive techniques, they require a crystal-clear view inside the body. Traditional HD displays and complex cabling solutions fail to deliver the required detail and reliability.

OR modernization mirrors the global trend toward 4K ecosystems and reliable, low-latency transport. 12G-SDI provides pragmatic single-link 4K60 carriage with robust EMI tolerance ideal for hybrid operating rooms.

The modernization of operating rooms in the Middle East closely follows global trends, with a strong emphasis on adopting full 4K imaging ecosystems10. For minimally invasive surgery, the detail, color fidelity, and depth perception offered by 4K resolution are no longer a luxury but a clinical necessity. However, delivering a pristine 4K signal from the endoscope to the display presents a technical challenge. The solution gaining traction is 12G-SDI (SMPTE ST 2082), a professional video standard that offers a pragmatic approach to signal transport. It provides uncompressed 2160p60 (4K at 60 frames per second) video over a single, robust coaxial cable, which is crucial for reliability in the electromagnetically noisy OR environment. This single-link simplicity is perfectly suited for integration into surgical towers and ceiling-mounted booms found in modern hybrid ORs and teaching theaters. A surgical monitor like the MS321PB with native 12G-SDI11 input ensures a direct, low-latency connection, preserving image integrity from the source to the screen.

| Feature | 12G-SDI | Quad 3G-SDI / HDMI |

|---|---|---|

| Cabling | Single Coaxial | 4x Coaxial or 1x HDMI |

| Max Distance | ~100 meters | ~10–20 meters (HDMI) |

| Reliability | High, locking connector | Moderate, friction-fit |

| EMI Tolerance | Excellent | Good to Poor |

Compliance first: SFDA market entry

Gaining market access in Saudi Arabia is impossible without regulatory approval. Many international device manufacturers underestimate the strictness of SFDA requirements, leading to costly import and sales delays.

SFDA registration is a non-negotiable prerequisite for customs clearance and sales in Saudi Arabia. Providing partners with a clear "KSA entry checklist" alongside product information helps de-risk the buyer journey.

In the Kingdom of Saudi Arabia, the Saudi Food and Drug Authority (SFDA)12 is the ultimate gatekeeper for all medical devices. Without formal Marketing Authorization from the SFDA, a product cannot be legally imported, cleared through customs, or sold to any public or private sector entity. The regulatory framework, particularly guideline MDS-G008, clearly defines device classification rules and the extensive documentation required for registration. Overlooking or underestimating these requirements is a common pitfall that can stall market entry indefinitely. For local distributors and hospital procurement teams, the vendor’s SFDA status is one of the first and most critical due diligence checks. To facilitate a smoother market entry, it is essential to proactively manage this process. By providing a simple "KSA Entry Checklist13" alongside product pages for devices like the MD22CA, manufacturers can demonstrate their regulatory readiness. This simple tool helps de-risk the journey for local partners and assures them that the product is fully compliant and ready for onboarding.

PACS seats grow at 3–4MP

As GCC hospitals digitize their radiology departments, the need for clinical review stations expands rapidly. However, equipping every workstation with a high-end diagnostic monitor is not financially viable.

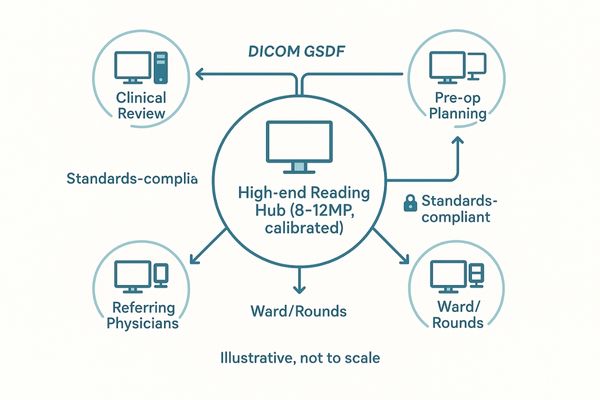

Hospitals will add many calibrated 3MP to 4MP clinical review seats around premium 8MP to 12MP hubs. Mapping portfolios to this "hub-and-spoke" model improves tender fit and inventory turns.

The comprehensive digitization of radiology departments across the GCC is creating a tiered demand for medical displays14. While the primary diagnostic reading room requires premium 8MP to 12MP monitors for radiologists, there is a much larger, growing need for clinical review stations. These "spokes" are used by referring physicians, surgeons in pre-operative planning, and clinicians on hospital wards to view images and reports from the central PACS. For these applications, a calibrated 3MP or 4MP monitor provides the necessary image quality without the high cost of a primary diagnostic display. This "hub-and-spoke" topology is becoming the standard deployment model. Vendors who understand this structure can better align their portfolios to meet tender requirements effectively. Offering a range of monitors, including dual-screen 4MP solutions like the MD45C for the spokes and high-end models for the hub, allows a vendor to provide a complete, cost-effective solution for the entire hospital. This strategy improves tender fit, optimizes inventory for local partners, and supports the scalable growth of digital healthcare infrastructure.

Conclusion

Success in the Middle East’s medical display market requires aligning product portfolios with the region’s specific procurement, clinical, and regulatory demands for a tender-ready approach.

👉 For region-specific tender strategies and portfolio alignment, contact Martin at martin@reshinmonitors.com — we’ll help you build a compliant, competitive bid.

-

Exploring Vision 2030 will provide insights into its impact on procurement and healthcare advancements. ↩

-

Understanding the standards for reading rooms is crucial for ensuring quality in medical imaging and compliance. ↩

-

This resource will explain the importance of high-resolution PACS seats in enhancing diagnostic accuracy and workflow efficiency in radiology. ↩

-

Understanding NUPCO’s role can help vendors navigate the procurement process effectively and improve their chances of success. ↩

-

Exploring the concept of being ‘tender-ready’ will provide insights into the necessary preparations for successful bids. ↩

-

Explore this link to understand how teleradiology hubs enhance efficiency and connectivity in modern healthcare. ↩

-

Discover the advantages of 12MP monitors in medical imaging and how they can improve diagnostic accuracy and workflow. ↩

-

Explore this link to understand how DBT enhances breast cancer screening accuracy and improves patient outcomes. ↩

-

Learn about the importance of high-resolution monitors in mammography for better diagnostic confidence and efficiency. ↩

-

Explore how 4K imaging enhances surgical precision and outcomes, making it essential for modern operating rooms. ↩

-

Learn about 12G-SDI’s role in delivering high-quality video signals, crucial for effective minimally invasive surgeries. ↩

-

Understanding the SFDA’s role is crucial for compliance and successful market entry in Saudi Arabia. ↩

-

A comprehensive KSA Entry Checklist can streamline the registration process and ensure regulatory compliance. ↩

-

Explore this link to discover the latest advancements in medical displays that enhance diagnostic accuracy and efficiency. ↩