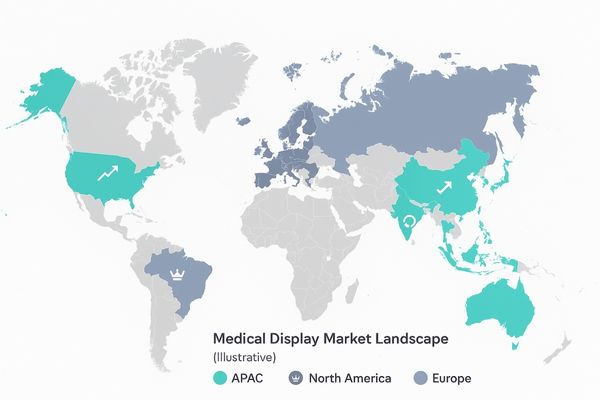

The global medical display market appears fragmented and complex. Misinterpreting regional trends can lead to flawed strategies and missed opportunities in both high-growth and high-value segments.

This article compares the APAC, North American, and European medical display markets, analyzing key growth drivers like technology and telemedicine alongside challenges such as infrastructure and replacement cycles. I will explore differentiated strategies required for success in each unique region.

Understanding the global landscape requires a detailed look at its constituent parts. The world is not a single, uniform market; it is a collection of distinct regions, each with its own economic drivers, healthcare priorities1, regulatory environments, and technological adoption rates. A strategy that succeeds in the fast-growing markets of Asia may be ill-suited for the mature, replacement-driven markets of Europe. Likewise, the demands of the premium-focused U.S. healthcare system differ significantly from the needs of emerging economies where cost-effectiveness is paramount. For manufacturers and distributors, navigating these differences is the key to sustainable growth2. It requires a product portfolio flexible enough to meet various clinical needs and price points, from a standard FHD surgical monitor like the MS220S for general procedures to advanced 4K displays for complex minimally invasive surgeries. This regional analysis will provide clarity on where the opportunities lie.

APAC Market Leading Global Growth

Expanding into the Asia-Pacific (APAC) region seems promising but daunting. The sheer scale and diversity across countries can feel overwhelming, potentially causing hesitation and inaction.

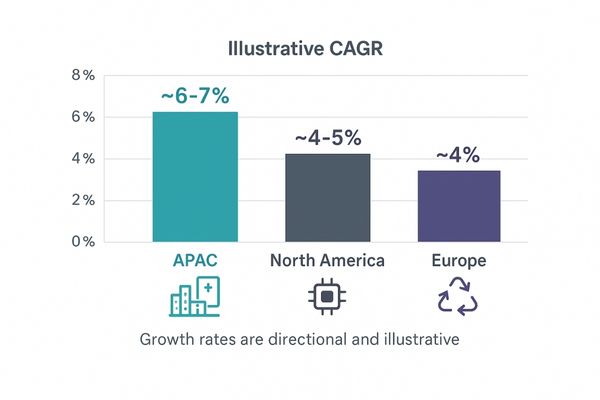

APAC is positioned to lead global growth, fueled by its large population, rapid urbanization, and government investments in digital healthcare. With projected annual growth of 6–7%, the region may soon become the world’s largest market.

The Asia-Pacific region is a powerhouse of demand, driven by a combination of factors that create a fertile ground for medical technology adoption3. Massive government-led initiatives, such as China’s push to digitize its hospital infrastructure and India’s focus on expanding telemedicine to rural areas, are generating enormous demand for an entire spectrum of medical equipment, including displays. In more developed markets like Japan and South Korea, aging populations are increasing the need for advanced surgical procedures, which in turn fuels demand for high-performance specialty monitors4. This diverse landscape requires a flexible product strategy. There is a need for both large-format 4K systems like the MS550P for state-of-the-art operating rooms in Shanghai, as well as cost-effective, reliable displays for regional surgical centers in Southeast Asia. The region’s projected growth is not just a forecast; it is a reflection of a fundamental, long-term transformation in regional healthcare delivery.

| APAC Sub-region | Key Market Driver | Typical Demand Profile |

|---|---|---|

| China | Hospital digitalization projects | Full spectrum, from high-end to volume segments |

| India | Telemedicine, private healthcare | Cost-effective, reliable displays for remote use |

| Japan | Aging population, high standards | Premium, 4K surgical monitors |

| ASEAN | Developing healthcare infrastructure | Mid-range and entry-level FHD solutions |

North America Retains Leadership in Premium Segment

North America’s market may seem saturated with slower growth. This perception can lead manufacturers to deprioritize a region that continues to dominate the high-value, premium technology segment.

Led by the United States, North America maintains its leadership in the premium medical display market through high healthcare investment and rapid adoption of new technologies. Growth is moderate but commands the high-end niche.

While APAC leads in volume and growth rate, North America, and particularly the U.S., sets the standard for technological adoption and commands the highest average selling prices. The market is defined by a cycle of replacement and technological upgrades5 rather than greenfield installations. Large hospital networks continuously invest to maintain their competitive edge, driving demand for the most advanced technologies available. This includes upgrading from HD to 4K displays6, adopting monitors with specialized surgical viewing modes, and integrating solutions that optimize workflow within integrated operating rooms. For these clients, purchasing decisions are driven by performance, a proven return on investment, and seamless integration with surgical video systems. A premium 32-inch 4K monitor like the MS321PC is well-suited for this environment, where the expectation is for uncompromising image quality and features that support the most demanding robotic and endoscopic procedures.

Europe’s Moderate Growth Driven by Replacement Demand

The European market can appear stagnant compared to emerging regions. This view overlooks the consistent and predictable demand driven by high clinical standards and regular equipment replacement cycles.

Europe’s mature market shows moderate growth of around 4%, driven mainly by equipment replacement and upgrades. High standards for imaging accuracy and a growing emphasis on environmental regulations shape purchasing decisions.

The European medical display market is characterized by maturity and stability. With a high penetration of minimally invasive surgery, growth primarily comes from hospitals replacing aging equipment with newer, more capable models. This replacement cycle is influenced by several factors. First, stringent clinical standards and regulations demand high levels of image accuracy and color fidelity, prompting upgrades to 4K displays7. Second, there is a growing emphasis on sustainability and operational efficiency8. Hospitals in Germany, the UK, and France actively seek products with lower power consumption and materials that comply with environmental standards like RoHS. Therefore, manufacturers must not only highlight the clinical benefits but also the total cost of ownership and ecological footprint of their products. A versatile 4K monitor like the MS275P fits well here, offering a significant performance upgrade in a popular size while meeting modern efficiency requirements.

Technological Innovation Driving Global Demand Upgrade

Sticking with older, existing display technology seems like a cost-saving measure. However, this approach risks surgical competitiveness as new camera systems and techniques demand higher performance standards.

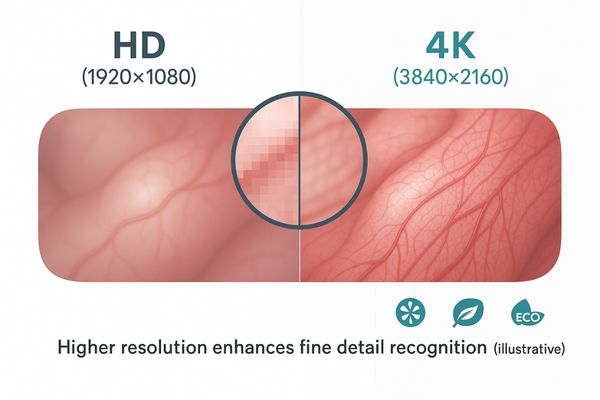

Innovations like 4K/8K resolution, advanced backlighting, and specialized surgical modes are redefining performance benchmarks. This technological push is compelling hospitals worldwide to upgrade displays to keep pace with modern surgery.

Technology is a primary catalyst for growth across all regions. The transition from HD to 4K9 is becoming standard for endoscopic and laparoscopic surgery, offering surgeons four times the detail for better tissue differentiation and anatomical visualization. Beyond resolution, advancements in panel technology offer wider color gamuts and deeper blacks, critical for accurate vessel identification. Furthermore, intelligent features are becoming key differentiators, such as preset configurations for different surgical specialties (e.g., Laparoscopy, Endoscopy, Urology) that optimize the image instantly. This wave of innovation is shortening replacement cycles. To remain competitive, surgical departments must invest in displays that can accurately render the data from the latest 4K camera systems. A premium monitor like the MS321PB, with its exceptional clarity, is essential to leverage these advancements in minimally invasive procedures.

Telemedicine and Aging Population as Dual Drivers

Market drivers can often seem abstract and distant. Ignoring fundamental shifts like demographics and new care delivery models means failing to address powerful, long-term sources of demand.

The global expansion of telemedicine and a growing aging population are powerful dual drivers for the medical display market. Remote surgical proctoring demands high-fidelity displays, while a higher volume of procedures requires more equipped ORs.

Two significant global trends are converging to create sustained, long-term demand for surgical displays. First, the adoption of telesurgery and remote proctoring10 allows expert surgeons to mentor colleagues from anywhere in the world. This practice requires a large, high-resolution monitor in the operating room so the entire local team can clearly see the details being pointed out by the remote expert. Second, the world’s aging population11 is leading to a higher volume of surgical procedures. This demographic shift translates directly into the need for more and better-equipped operating rooms to handle the increased patient load. A large-format display like the MS430PC is ideal for this environment, providing a clear, commanding view for the entire surgical team and facilitating effective collaboration, whether in-person or remote.

Infrastructure and Cost Challenges in Emerging Markets

The potential in emerging markets is undeniable. However, a lack of digital infrastructure and budget constraints often slow the adoption of high-performance medical technology, creating a barrier to entry.

While emerging markets have strong growth potential, limited digital infrastructure and the high cost of premium equipment act as significant brakes on adoption. Success requires overcoming these cost and educational hurdles.

The path to capturing growth in emerging markets across APAC, Latin America, and Africa is paved with challenges. Many smaller hospitals and regional surgical centers lack the robust infrastructure needed for fully integrated digital ORs. Even with sufficient infrastructure, tight budgets often make premium 4K surgical displays12 prohibitively expensive. This creates a significant gap between clinical need and purchasing capability. To succeed in these regions, manufacturers cannot simply offer their premium products at a lower price. Instead, they must develop solutions tailored to these environments. This could include creating cost-effective, high-performing FHD models13 that deliver the reliability needed for general surgery. Focusing on durable, easy-to-use products like the MS192SA is a sound strategy. Furthermore, investing in local training is vital to build market awareness and prove the clinical value of upgrading from non-medical grade monitors.

| Challenge | Mitigation Strategy for Manufacturers |

|---|---|

| High Initial Cost | Offer cost-effective FHD models with core surgical features |

| Limited IT Infrastructure | Provide standalone solutions that are easy to install and use |

| Lack of Awareness | Invest in local training, workshops, and clinical demonstrations |

| Service & Support | Build a reliable local distribution and technical support network |

Extended Replacement Cycles in Mature Markets

In cost-conscious healthcare environments, IT departments are pushed to maximize the lifespan of every asset. This can lead to extended replacement cycles for displays, slowing down demand in mature markets.

Hospitals in North America and Europe are extending display lifespans to control costs, which can delay new purchases. To counter this, manufacturers must offer compelling value that justifies an upgrade.

In the mature markets of North America and Europe, healthcare providers face constant pressure to manage operational costs. This often leads to a strategy of extending the useful life of capital equipment, including surgical displays14, beyond the typical 3-5 year cycle. This trend poses a direct challenge to manufacturers who rely on regular replacement sales. To overcome this, the value proposition for a new purchase must be overwhelmingly clear. It is no longer enough to offer a marginal improvement in brightness. The upgrade must provide a significant enhancement in surgical visualization, workflow efficiency, or long-term reliability. A monitor like the MS247SA, which offers a substantial upgrade in size and image quality over older, smaller displays, provides a strong justification for investment by demonstrating a clear return in improved surgical precision and team communication.

Differentiated Strategies for Distributors and Manufacturers

A one-size-fits-all global sales strategy is destined to fail. Selling products in the same way in Germany and Indonesia ignores the vastly different needs, regulations, and competitive landscapes.

Market needs vary dramatically by region, requiring tailored strategies for product portfolios, marketing, and sales. Success depends on adapting to local regulations, clinical practices, and budget realities.

To achieve sustainable global success, both manufacturers and their distribution partners must adopt a highly differentiated, region-specific approach. In Europe, this means emphasizing CE MDR certification15 and adherence to OR safety standards. In North America, the focus should be on FDA clearance16 and seamless integration with major surgical video tower vendors. In APAC, the strategy must be even more nuanced, with a flexible portfolio that addresses both premium 4K and cost-sensitive FHD segments, supported by a strong local service network. For a brand like ours, this means ensuring our products, such as the widely certified MS270P surgical display, not only meet international standards but are also positioned correctly within each local market. Building long-term competitive advantage is about combining a superior product with the right certifications and a sales approach that addresses the unique pain points of each regional market.

Conclusion

Success in the global medical display market requires a nuanced, region-specific strategy that addresses disparate growth rates, technological demands, and economic realities across APAC, Europe, and North America.

📩 Looking for medical display solutions tailored to different regional markets? Contact Martin at martin@reshinmonitors.com for strategic insights and Reshin’s global-ready product lineup.

- This resource will provide insights into regional healthcare needs, essential for tailoring effective strategies. ↩

- Explore this link to understand how businesses can adapt and thrive in varying economic landscapes. ↩

- Explore this link to understand the latest trends and innovations in medical technology adoption, crucial for staying ahead in the healthcare industry. ↩

- Discover how high-performance specialty monitors are revolutionizing healthcare delivery and improving patient outcomes in modern medical facilities. ↩

- Explore this link to discover cutting-edge technological upgrades that can enhance healthcare delivery and patient outcomes. ↩

- Learn how 4K displays are revolutionizing surgical procedures, providing superior image quality and precision for medical professionals. ↩

- Explore how 4K displays enhance image accuracy and clinical outcomes in medical environments. ↩

- Learn about strategies hospitals can adopt to enhance sustainability and reduce operational costs. ↩

- Explore how 4K technology enhances surgical precision and visualization, crucial for modern medical practices. ↩

- Exploring this resource will provide insights into how telesurgery enhances surgical training and collaboration globally. ↩

- This link will help you understand the implications of demographic changes on healthcare and surgical needs. ↩

- Explore this link to understand how 4K surgical displays enhance surgical precision and improve patient outcomes. ↩

- Discover insights on FHD models that balance performance and budget, making them ideal for emerging markets. ↩

- Explore this link to discover cutting-edge surgical display technologies that enhance visualization and improve surgical outcomes. ↩

- Understanding CE MDR certification is crucial for manufacturers to ensure compliance and market access in Europe. ↩

- Exploring FDA clearance helps manufacturers navigate regulatory requirements and enhance product credibility in North America. ↩