Navigating the complex web of global policies can be daunting. Misunderstanding these regulations can lead to market access issues, compliance failures, and missed opportunities, hindering growth and innovation.

Policy factors are profoundly shaping the global medical-grade display market. Stricter regulations raise safety and quality thresholds; health insurance and cost-control policies affect hospital purchasing and upgrade cycles; telemedicine legislation expands demand beyond hospitals; digital transformation initiatives drive continuous investment in advanced displays; and green procurement policies push manufacturers toward energy-efficient and sustainable innovations. Together, these policies present both challenges and opportunities, defining the pace and direction of market growth.

The landscape for medical technology is not shaped by innovation alone; it is carved out by the powerful currents of government policy1. For manufacturers of medical-grade displays, understanding these forces is not just a matter of compliance—it is a strategic necessity. From stringent new device regulations in Europe to the rapid expansion of government-backed telemedicine in Asia, policy decisions create the frameworks within which we must operate. These rules dictate everything from product design and certification pathways to a hospital’s ability to purchase new equipment. Navigating this environment requires a deep understanding of how regulatory standards2, public health economics, and national digitization strategies intersect. In the following sections, I will explore the key policy factors that are defining the challenges and unlocking the opportunities within the global medical-grade display market today.

Changes in Medical Device Regulatory Standards

Keeping up with constantly evolving medical device regulations is a significant challenge. Failing to comply with new standards can result in being locked out of major international markets.

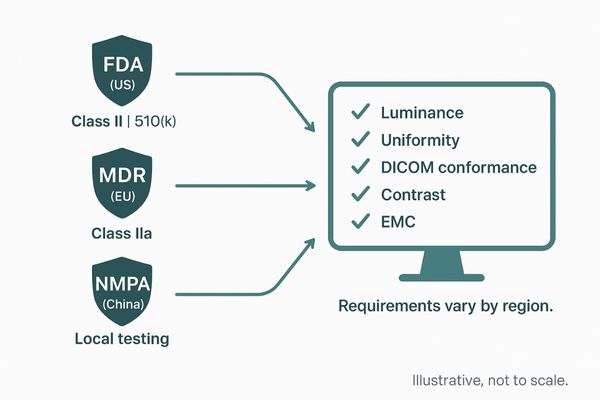

Stricter regulations like the EU’s MDR and the FDA’s 510(k) pathway raise quality and safety standards for medical displays. While this new oversight increases trust, it also elevates compliance costs and time-to-market.

In recent years, I have seen a clear global trend toward more stringent oversight of medical devices, which directly impacts the display market. In the European Union, the Medical Device Regulation (MDR)3 now classifies diagnostic displays as Class IIa devices, subjecting them to a much more rigorous certification process. This ensures that every monitor meets high standards for luminance, resolution, and grayscale accuracy, but it also extends development timelines and adds significant compliance costs. Similarly, in the United States, the FDA classifies these displays as Class II devices requiring a 510(k) premarket submission4. The FDA has issued specific guidance on performance data, demanding proof of brightness uniformity, contrast, and DICOM conformance. In China, the National Medical Products Administration (NMPA) is aligning its regulations with international benchmarks, introducing new risk categories and local testing requirements that can delay entry for foreign products. This global tightening of rules creates a higher barrier to entry but ultimately elevates the quality and reliability of products across the industry.

| Regulatory Body | Region | Classification for Diagnostic Displays | Key Requirement |

|---|---|---|---|

| European Union | EU | Class IIa (Medium Risk) | Strict review and certification under MDR |

| FDA | United States | Class II | 510(k) premarket review and performance data |

| NMPA | China | Varies (Strengthening alignment) | Local type testing and adherence to new rules |

Impact of Public Health Insurance Policies

Hospitals operate under tight budgetary constraints, often dictated by public insurance policies. These financial pressures can force them to delay essential equipment upgrades, impacting patient care.

Public health insurance policies create a tension between cost control and quality improvement. This directly influences hospital purchasing decisions and replacement cycles for high-performance medical-grade displays, shaping market demand.

The purchasing power of healthcare providers is directly tied to reimbursement systems5, making public health insurance a powerful market force. In countries with nationalized healthcare systems like the UK, cost-containment measures and fixed annual budgets mean that procurement decisions for equipment like medical displays are scrutinized heavily. Hospitals must prove the cost-effectiveness of any new investment, which can lead to extended replacement cycles. In the United States, the dynamic is different but just as impactful. The mix of Medicare and private insurance creates a complex environment; while reduced reimbursement rates for imaging procedures can stifle investment, the push toward value-based care6 can encourage it. Hospitals are incentivized to invest in technology that improves diagnostic accuracy and reduces the need for repeat exams. This is where a high-quality display can demonstrate clear value. In China, national cost-control policies have intensified competition, favoring local manufacturers who can offer compliant, lower-cost solutions and forcing multinational brands to adapt their pricing strategies to remain competitive.

Telemedicine Policies Driving New Demand

Traditionally, diagnostic imaging has been confined within the hospital walls. This centralization limits access to specialist expertise and creates workflow bottlenecks for healthcare providers.

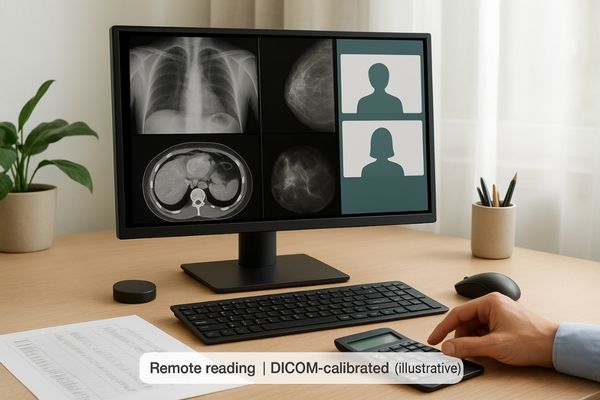

Government policies expanding reimbursement for telemedicine have created new demand for diagnostic-grade displays outside of hospitals. This shift supports remote radiology, pathology, and virtual consultations, decentralizing healthcare delivery.

The COVID-19 pandemic acted as a massive catalyst for telemedicine7, with governments worldwide rapidly enacting policies to support remote healthcare. These changes have fundamentally expanded the market for medical-grade displays8. By broadening reimbursement for telehealth services, regulators enabled remote radiology and pathology on an unprecedented scale. In the U.S., temporary Medicare rules allowed radiologists to perform diagnostic reads from home, creating an immediate need for compliant displays in non-traditional settings. Similar policies in Europe and Canada also facilitated remote diagnostics, with the crucial requirement that the home-based monitors meet the same stringent performance standards as those used in hospitals. In China, national policies promoting "Internet hospitals" have spurred the development of regional imaging hubs where specialists at major hospitals provide guidance to clinicians at lower-tier facilities. This distributed model relies entirely on a network of high-quality, calibrated displays to ensure diagnostic consistency and reliability across vast distances. This policy-driven shift has permanently broadened the market beyond the physical hospital.

Impact of Hospital Digital Transformation Policies

Aging hospital IT infrastructure and reliance on outdated film-based imaging create inefficiencies. These legacy systems hinder collaboration and can compromise the quality of patient care.

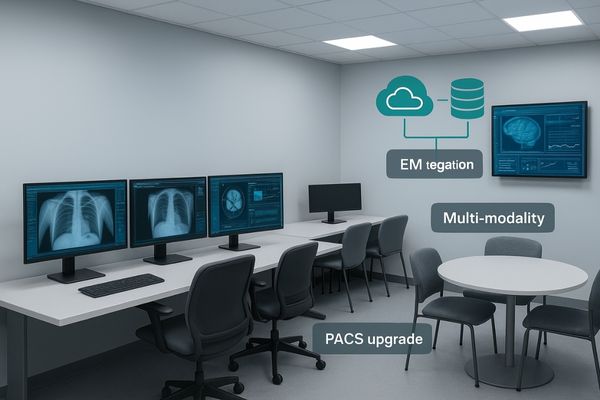

Government-funded digital health strategies and "smart hospital" initiatives are fueling sustained demand for medical displays. As imaging becomes fully digital, high-performance monitors are now essential tools across all clinical departments.

Government-led initiatives to modernize healthcare are powerful drivers of investment in medical technology. In Europe, I see large-scale funding programs designed to help hospitals upgrade their IT infrastructure, including the adoption of comprehensive electronic health records9 and picture archiving and communication systems (PACS). These projects trigger large procurement cycles for diagnostic-grade displays needed in radiology reading rooms and clinical review stations. In China, ambitious "smart hospital" programs are accelerating the deployment of advanced imaging workstations across facilities of all sizes, making fully digital workflows the new standard. A reliable multi-modality monitor becomes a cornerstone of this transformation. The Asia-Pacific region is currently the fastest-growing market, largely due to rising government and private investment in healthcare digitization. Every step in this digital evolution—from upgrading a PACS to implementing a tele-education platform—creates fresh demand for certified, high-quality displays, ensuring a continuous and growing need for advanced visualization tools.

Green Procurement and Sustainable Healthcare Compliance

The healthcare industry has a significant environmental footprint. Many procurement decisions have historically overlooked sustainability criteria like energy consumption and material lifecycle, contributing to waste and high operational costs.

Sustainability policies are now shaping procurement, with hospitals favoring energy-efficient and eco-friendly displays. Manufacturers must meet environmental standards, positioning sustainability as a key competitive advantage in the market.

Sustainability is no longer a peripheral concern; it is becoming a core component of healthcare policy and procurement. In Europe and the UK, healthcare systems are actively integrating environmental criteria into their purchasing decisions. Hospitals are now required to consider factors such as carbon footprint10, energy efficiency11, and material recyclability when selecting new equipment. This means that manufacturers must now demonstrate compliance with standards like the EU’s directives on hazardous substances (RoHS) and electronic waste disposal (WEEE). The shift toward energy-efficient technologies, such as equipping a surgical monitor with an LED backlight instead of older CCFL technology, is a direct result of this trend. Furthermore, hospitals are increasingly analyzing the total lifecycle cost of a product, favoring durable, energy-efficient displays that reduce electricity consumption and need to be replaced less frequently. As the global healthcare sector moves toward carbon neutrality, the environmental performance of a display is becoming as important as its clinical performance, creating a new axis of competition for manufacturers.

Conclusion

From a global perspective, policy factors create both opportunities and challenges for the medical-grade display market. Regulations raise quality and trust but add compliance hurdles; health insurance balances cost control with quality in purchasing; telemedicine expands demand beyond hospitals; digital transformation drives ongoing investment; and sustainability mandates push greener, energy-efficient solutions. Companies that adapt quickly will gain an edge, while healthcare providers benefit from policy-driven upgrades that enhance diagnosis, collaboration, and efficiency, ultimately improving patient outcomes.

📩 Want to navigate policy-driven shifts with the right medical display strategy? Contact Martin at martin@reshinmonitors.com for expert insights and solutions from Reshin.

- Understanding the influence of government policy is crucial for navigating the medical technology landscape effectively. ↩

- Exploring regulatory standards helps manufacturers ensure compliance and optimize their product development strategies. ↩

- Understanding the MDR is crucial for navigating the evolving landscape of medical device regulations and ensuring compliance. ↩

- Exploring the 510(k) process can provide insights into the FDA’s requirements for medical devices, essential for manufacturers. ↩

- Understanding reimbursement systems is crucial for healthcare providers to navigate financial challenges and optimize their investments. ↩

- Exploring value-based care can provide insights into how hospitals can improve patient outcomes while managing costs effectively. ↩

- Exploring this link will provide insights into how telemedicine is transforming healthcare delivery and access. ↩

- This resource will explain the critical role of medical-grade displays in ensuring accurate remote diagnostics. ↩

- Explore this link to understand how electronic health records enhance patient care and streamline healthcare processes. ↩

- This resource will offer valuable strategies for healthcare systems aiming to minimize their environmental impact. ↩

- Exploring this link will provide insights into how energy efficiency can enhance healthcare sustainability and reduce costs. ↩