Budgeting for medical equipment is a major challenge when prices seem to fluctuate without clear reason. This uncertainty can delay critical technology upgrades, forcing clinicians to work with outdated tools. A clear understanding of market dynamics is the best way to develop a confident procurement strategy.

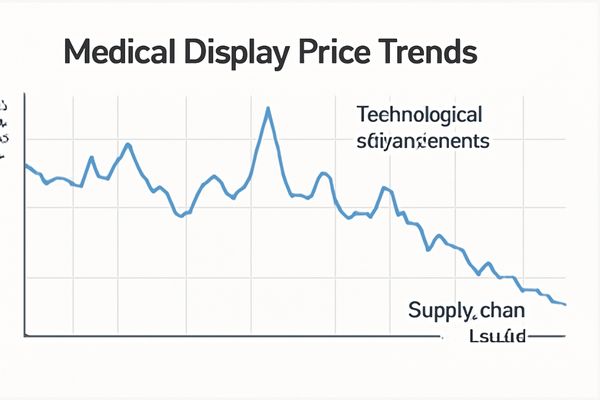

Medical display prices are shaped by a mix of factors. Technological advances and growing global demand tend to lower costs over time, while supply chain issues create short-term spikes. The market is stabilizing, but premium features will always command higher prices.

The price you pay for a medical display is not an arbitrary number. It is the end result of a complex interplay between innovation, global economics, and manufacturing realities. Examining these forces provides the clarity needed to make strategic investment decisions for your institution.

Technological Advancements Influence Price Fluctuations

Investing in the latest technology feels like a gamble when prices for new models are high. Waiting too long can leave your institution behind, but buying too early means overpaying for a feature that will soon become standard.

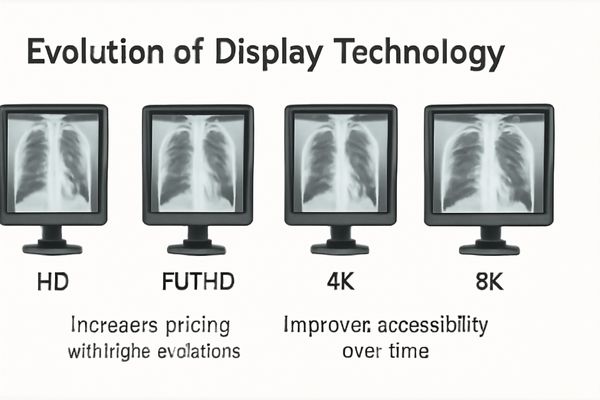

As advanced technologies like 4K, 8K, and AI integration mature, the prices for high-end medical displays gradually decrease. Meanwhile, pricing for established entry-level models remains relatively stable.

New technology always follows a predictable pricing curve. When a feature like 4K resolution1 was first introduced in surgical displays, the cost was substantial. This premium covered the extensive research, development, and initial tooling costs required to produce the new panels and electronics. Early adopters paid for this innovation. However, as more manufacturers adopt the technology and production volume increases, the cost of components falls dramatically. This is a classic example of economies of scale2. Today, 4K resolution is the standard for modern operating rooms, and its price reflects that maturity. We see the same trend happening now with 8K and integrated AI features. While these currently represent the high end of the market, their costs will inevitably decline over the next several years. The MS550P – 55" 4K Surgical Monitor is a prime example of a technology that has transitioned from a premium feature to an accessible standard, offering immense clinical value at a mature price point.

Rising Demand in Emerging Markets Affects Pricing Dynamics

It can be difficult to see how global demand shifts in other countries affect your hospital’s budget. This perceived disconnect can make you question if you are receiving a fair price during procurement negotiations.

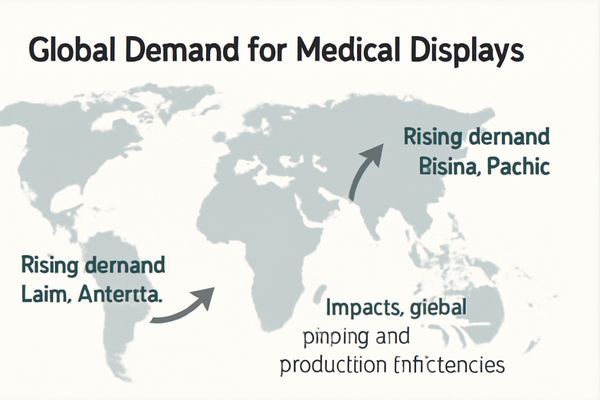

The increasing demand for medical digitalization in emerging markets is boosting global procurement volumes. This increased scale creates manufacturing efficiencies that exert downward pressure on overall pricing.

Massive investments in healthcare infrastructure3 are underway in regions across the Asia-Pacific, Latin America, and Eastern Europe. Government initiatives and the expansion of private healthcare networks are driving the digitalization of hospitals on an unprecedented scale. This creates enormous demand for all types of medical equipment, including displays. When manufacturers receive large-volume orders, they can optimize production lines, secure better rates on raw materials like LCD panels and semiconductors, and spread fixed costs over a greater number of units. This enhanced efficiency directly translates into a lower per-unit cost. While this trend most impacts high-volume products, its ripple effect helps moderate prices across the board. An endoscopic monitor4 like the MS220S – 22" FHD Endoscopic Monitor, a workhorse product for many procedures, is a key beneficiary of this global demand, allowing us to offer powerful performance at a competitive price.

| Production Volume | Per-Unit Cost | Market Effect |

|---|---|---|

| Low Volume | High | Premium pricing for niche, new tech |

| Medium Volume | Moderate | Stable pricing for mature products |

| High Volume | Low | Downward pressure on global prices |

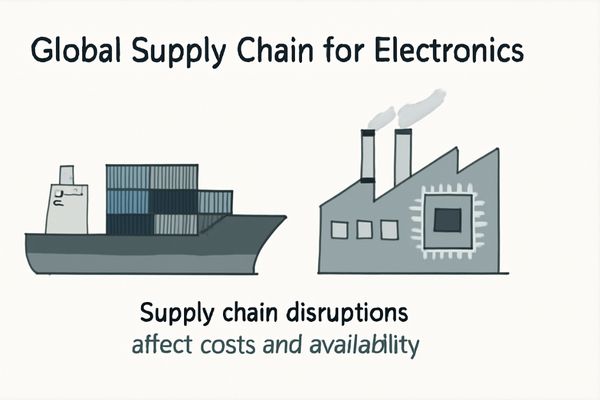

Supply Chain Disruptions Create Short-Term Cost Pressures

Sudden, unexpected price hikes from suppliers can derail carefully planned budgets. These disruptions create significant procurement challenges and can force difficult decisions about delaying essential upgrades.

Supply chain instability, driven by material shortages and geopolitical factors, has caused temporary price spikes. However, manufacturers are actively mitigating these pressures by diversifying their sourcing strategies.

In recent years, the global supply chain has faced historic challenges. The shortage of semiconductors5, a critical component in every modern display, has been the most visible issue. However, other factors also contribute to cost volatility. The rising cost of shipping, fluctuations in the price of raw materials like glass and copper, and regional lockdowns have all created bottlenecks. When a single component is unavailable, it can halt an entire production run, leading to delays and increased costs. To combat this, we and other responsible manufacturers have invested heavily in creating more resilient supply chains. This involves qualifying multiple suppliers for critical components, increasing raw material inventory, and diversifying manufacturing locations to reduce dependence on any single region. While these strategies help stabilize long-term supply, short-term price adjustments are sometimes unavoidable. Products like the versatile MD26C – 24" Diagnostic Monitor rely on numerous global components, making supply chain resilience6 a top priority.

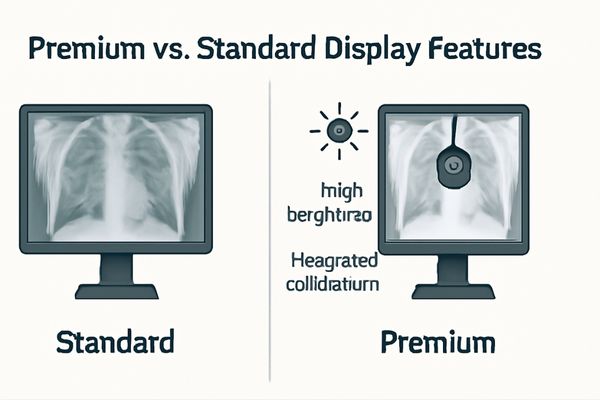

Premium Features Drive Segmentation in Product Pricing

Two displays can appear similar on the surface but have vastly different price tags. This discrepancy can make it difficult to justify the higher-cost option to a procurement committee without a clear breakdown of the value.

Displays with premium features such as exceptionally high brightness, integrated color calibration, and advanced input interfaces will consistently command a higher price, creating clear segmentation in the market.

The price difference between a standard and a premium medical display7 is rooted in tangible engineering and component costs. These are not arbitrary markups; they reflect the hardware required to meet the demands of specific clinical environments. For instance, a surgical display must be incredibly bright to overcome the powerful overhead lights in an operating room. This requires a more complex and powerful LED backlight system and a robust power supply, increasing its cost. Similarly, a mammography display requires a built-in sensor for automated DICOM and color calibration, adding to its complexity. Advanced connectivity, such as 12G-SDI or fiber optic inputs for long-distance video transmission, also necessitates more expensive internal electronics. Finally, the protective front glass on a surgical monitor8 must be optically bonded and sealed to achieve a high IP rating against liquids, a meticulous and costly process. The MS430PC – 43" 4K Surgical Monitor integrates many of these premium features, justifying its position in a higher price segment.

| Feature | Standard Display | Premium Display | Price Impact |

|---|---|---|---|

| Brightness | ~350 cd/m² | >800 cd/m² | Significant |

| Calibration | Manual | Integrated Automated Sensor | Moderate |

| Inputs | HDMI/DP | SDI, Fiber Optic | Moderate |

| Front Panel | Basic Plastic Bezel | IP-Rated, Bonded Glass | Significant |

Future Price Stabilization Relies on Industry Maturity

The constant flux in technology and pricing makes long-term capital planning a challenge. Hospitals need predictability to develop effective, multi-year equipment lifecycle strategies.

As the medical display market matures and manufacturing achieves greater economies of scale, overall prices are expected to stabilize. The significant price gap between premium and basic models, however, will likely persist.

The medical display market is moving toward a more mature and stable state. Technologies that were once cutting-edge, like Full HD resolution, are now foundational. This standardization allows for highly efficient, high-volume production with predictable costs. We anticipate that this trend will continue, with 4K resolution9 becoming the new baseline for most clinical applications in the coming years. This will lead to greater price stability for mainstream products. However, the pace of innovation at the high end will not slow down. New frontiers like micro-LED panels10, 8K resolution, and deeper AI integration will continue to define the premium segment. These advanced displays will always command a higher price due to their specialized components and lower production volumes. Therefore, the market will settle into distinct, stable tiers, allowing for more accurate long-range budget forecasting. A straightforward, reliable model like the MS192SA – 19" HD Endoscopic Monitor represents the kind of stable, foundational product that provides a predictable cost base for institutions.

Conclusion

Understanding price trends empowers smarter procurement. Prices are shaped by technology lifecycles, global demand, supply chain resilience, and the value of premium features, leading to a predictably segmented market.

📩 Ready to make an informed investment in medical displays? Contact Martin at martin@reshinmonitors.com for expert guidance on optimizing your purchase strategy.

-

Explore this link to understand how 4K resolution enhances surgical precision and improves patient outcomes. ↩

-

Learn about economies of scale to see how they drive down costs and make advanced technologies more accessible. ↩

-

Exploring this resource will provide insights into the ongoing healthcare infrastructure investments shaping the future of medical services. ↩

-

This link will help you understand the advantages of endoscopic monitors, crucial for enhancing surgical outcomes and efficiency. ↩

-

Understanding the semiconductor shortage is crucial; this resource provides insights into its impact on various industries. ↩

-

Explore this link to discover effective strategies that can enhance your supply chain resilience and mitigate risks. ↩

-

Explore this link to understand how premium medical displays enhance clinical accuracy and patient care. ↩

-

This resource will guide you through essential features of surgical monitors, ensuring you make an informed purchase. ↩

-

Exploring this link will provide insights into how 4K resolution enhances clinical applications and improves image quality. ↩

-

This resource will help you understand the advantages of micro-LED technology in medical displays and its impact on the market. ↩