The high-end medical display market is fiercely competitive. This leaves hospitals with high costs and few choices. Understanding the market dynamics is key to finding better value and innovation.

The market is shaped by dominant brands, technological innovation, strategic partnerships, and distinct regional growth. Increasingly, customer demand is shifting from standalone hardware to integrated, intelligent solutions for modern healthcare.

The competitive landscape1 can appear daunting. However, it is not static. New technologies and evolving customer needs create openings for manufacturers who are agile and customer-focused. Success is no longer just about having the best specifications on paper. It is about delivering real, measurable value2 in a clinical setting. Let us dissect the forces driving this competition.

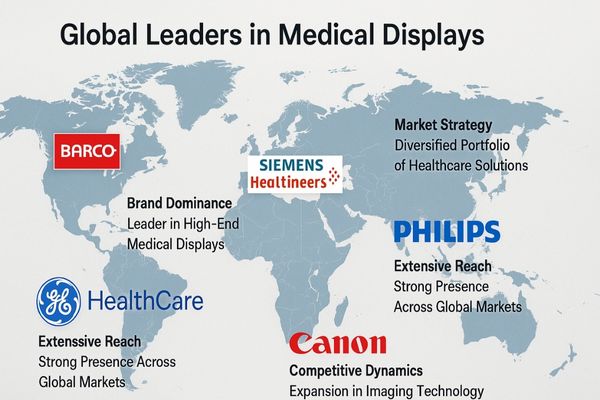

Leading Brands Dominate Premium Medical Display Segments

Trying to enter the premium market feels impossible. Established brands have a massive head start. We must analyze how these leaders maintain their control over the market.

A few global brands leverage technological barriers and certification advantages to maintain strong competitive positions. This dominance is built on years of investment in research, development, and brand trust.

The premium medical display market3 has high barriers to entry. The most significant barrier is the combination of technology and trust. Leading companies have spent decades and immense capital on research and development to perfect their display technology. This creates a significant technological gap. More importantly, they have built strong brand reputations and navigated the complex web of global medical device regulations. Obtaining certifications like FDA clearance4 in the United States or the CE mark under MDR in Europe is a long and expensive process. This acts as a powerful moat, preventing many new competitors from entering the high-end space. As a result, these established brands can often command premium prices, leaving hospital procurement departments with limited options and high costs for critical equipment. A product like our MS550P – 55" 4K Surgical Monitor is designed to challenge this by meeting these rigorous standards while offering competitive value.

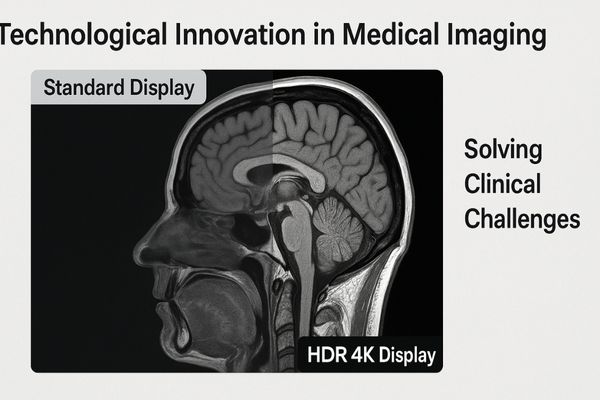

Technological Innovation Drives Competitive Differentiation

Simply matching existing specifications is not a viable strategy. Competitors are constantly innovating. True differentiation comes from pushing technology forward to solve clinical problems in new ways.

Continuous innovation is the primary engine of competition. Key differentiators now include ultra-high resolution like 4K and 8K, AI-assisted image processing and calibration, and High Dynamic Range (HDR) technology.

In the race for market leadership, technology is a key battleground. Competitors are moving beyond just increasing pixel counts. The focus is on smarter, more capable technologies that provide a tangible clinical advantage. For example, the transition to 4K and 8K resolution in surgical displays allows surgeons to see anatomical structures with unprecedented clarity. The introduction of Artificial Intelligence (AI)5 is another major shift. AI algorithms can automate complex calibration tasks, ensuring consistent image quality with minimal human intervention. AI can also assist in image processing to highlight potential anomalies. High Dynamic Range (HDR)6 technology is also becoming critical, especially in endoscopy. It allows a display to render deep blacks and bright highlights simultaneously, revealing details in shadowed cavities without blowing out bright, reflective surfaces. These are not just marketing features; they are functional tools that enhance diagnostic confidence and surgical precision. The MD120C – 12MP High-Precision Diagnostic Monitor with AI Calibration embodies this trend toward intelligent, self-managing display technology.

| Technology | Clinical Application | Key Benefit |

|---|---|---|

| 4K/8K Resolution | Minimally Invasive Surgery, Radiology | Enhanced detail for precise navigation and diagnosis. |

| AI Calibration | All Diagnostic Displays | Guarantees consistent image quality and compliance. |

| HDR (High Dynamic Range) | Endoscopy, Surgical Microscopy | Reveals critical detail in both shadows and bright areas. |

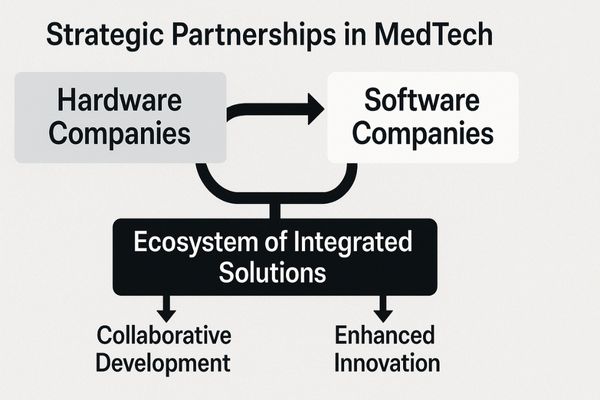

Mergers and Partnerships Reshape Market Landscape

The competitive field is not static. Major companies are constantly merging or forming alliances. This consolidation changes the strategic landscape for everyone involved in healthcare technology.

Companies are aggressively expanding their product portfolios and integrating across different technology platforms. They often achieve this through strategic mergers, acquisitions, and partnerships with other firms.

No single company can do everything well. This reality is driving a wave of strategic collaborations7 in the medical technology space. We see hardware manufacturers partnering with software companies, and display specialists forming alliances with surgical robot or imaging modality providers. The goal is to offer a more complete and integrated solution to the end customer. For a hospital, purchasing a pre-validated system that combines a surgical display8 with an OR integration platform is far simpler than buying individual components and hoping they work together. These partnerships create powerful ecosystems that can lock in customers and lock out competitors. This trend forces all manufacturers to think beyond their own products and consider how they fit into the broader clinical workflow. A display is no longer just a display; it is a component of a larger system. The versatile connectivity of our MS275P – 27" 4K Surgical Monitor, for example, is designed specifically for seamless integration into diverse operating room towers and video management systems.

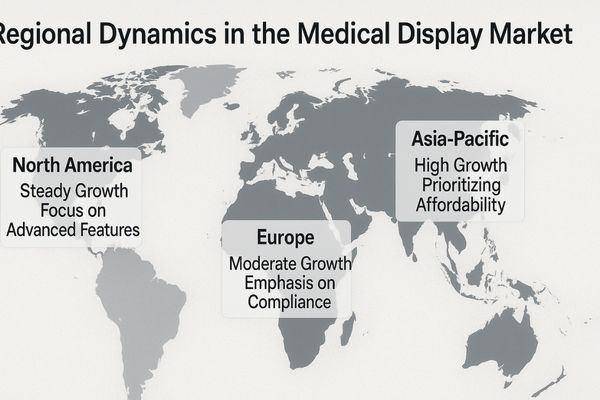

Regional Markets Show Distinct Growth Dynamics

A global strategy designed in one headquarters will not work everywhere. Different regions have unique needs, budgets, and regulations. Success requires a deep understanding of local market dynamics.

North America and Europe prioritize strict regulatory compliance and established standards. In contrast, growth in the much larger Asia-Pacific region is primarily fueled by rapid demand for medical digitalization.

The global market for high-end medical displays is not uniform. Each major region moves at its own pace and has its own priorities. In established markets like North America and Western Europe, the focus is often on replacement cycles and compliance with increasingly stringent regulations, such as the EU’s Medical Device Regulation (MDR)9. Hospitals here have well-defined procurement processes and a strong preference for brands with a long, proven track record. In contrast, the Asia-Pacific region is experiencing explosive growth. Governments and private entities are building thousands of new hospitals and clinics, all of which need to be equipped from the ground up. The drive toward digital transformation10 is immense. In these markets, there is often more openness to new brands that can provide advanced technology at a competitive price point, backed by responsive local service. Our strategy must be adaptable, tailoring product features and support models to fit these distinct regional needs. The MS321PB – 32" 4K Surgical Monitor strikes a balance of performance and value that is ideal for these rapidly expanding healthcare markets.

| Region | Primary Driver | Key Priority | Procurement Behavior |

|---|---|---|---|

| North America | Technology Refresh | FDA Compliance, Brand Trust | Formal, tender-based |

| Europe | Regulatory Changes (MDR) | CE Marking, Data Security | Standard-focused, risk-averse |

| Asia-Pacific | New Infrastructure | Digitalization, Scalability | Value-driven, rapid adoption |

Customer Demands Shift Toward Integrated Smart Solutions

Hospitals no longer want to buy just a great screen. They need displays that are smart, connected, and easy to manage. The very definition of a "high-end" display is evolving.

Customer demand is moving away from standalone, feature-heavy displays. The new focus is on fully integrated, intelligent solutions, which is compelling all manufacturers to rethink their competitive strategies.

The conversation with customers is changing. Five years ago, the discussion was about brightness and resolution. Today, it is about network connectivity11, remote management, and workflow integration. Hospital IT and clinical engineering departments need to manage hundreds, if not thousands, of devices across a large campus. They want displays that can be calibrated, monitored, and updated remotely from a central console. Surgeons and radiologists want displays that integrate seamlessly with PACS, EMRs, and OR video-over-IP systems. They want smart features, like automatic input switching or personalized user profiles that load with the tap of a badge. This shift means the display is becoming an active, intelligent node within the hospital’s digital ecosystem, rather than just a passive output device. Manufacturers who continue to compete only on panel specifications will be left behind. The future belongs to those who provide a complete, integrated, and intelligent solution. The MD85CA is an example of a product designed for this new reality, able to handle multi-modality inputs within a complex, networked environment.

Conclusion

Competition is intense, but the path forward is clear. Success requires technological innovation, strategic agility, and a deep focus on providing integrated solutions that meet real clinical needs.

📩 Want to stay competitive with cutting-edge medical display solutions? Contact Martin at martin@reshinmonitors.com for expert insights and tailored options from Reshin.

-

Understanding the competitive landscape helps businesses identify opportunities and threats, essential for strategic planning. ↩

-

Exploring ways to deliver measurable value can enhance patient outcomes and improve operational efficiency in healthcare. ↩

-

Explore this link to understand the complexities and barriers in the premium medical display market, which can inform strategic decisions. ↩

-

Learn about the FDA clearance process to grasp the regulatory challenges faced by medical device manufacturers. ↩

-

Explore this link to understand how AI is revolutionizing medical imaging, enhancing accuracy and efficiency in diagnostics. ↩

-

Discover the benefits of HDR technology in medical imaging, particularly in revealing critical details in complex visual scenarios. ↩

-

Exploring this resource will provide insights into how collaborations enhance innovation and efficiency in medical tech. ↩

-

This link will help you understand the critical role of surgical displays in modern healthcare settings. ↩

-

Understanding MDR is crucial for compliance in medical display procurement, ensuring safety and quality in healthcare. ↩

-

Exploring digital transformation reveals how technology is reshaping healthcare, improving efficiency and patient care. ↩

-

Explore how network connectivity enhances hospital displays, improving efficiency and integration in clinical settings. ↩