Ignoring the rapid healthcare evolution in Southeast Asia leaves manufacturers with outdated strategies. This results in missed opportunities in one of the world’s most dynamic emerging markets.

The expansion of the medical display market in Southeast Asia is driven by increased healthcare spending and digitalization. Success requires tailored strategies to navigate diverse adoption rates, price sensitivity, and the critical need for local support.

Southeast Asia represents a region of immense opportunity and complexity for the medical technology industry1. As nations across the area increase their focus on healthcare infrastructure2, the demand for advanced medical equipment, including specialized displays, is accelerating. However, this is not a monolithic market. Each country presents a unique combination of economic development, regulatory frameworks, and clinical needs. For manufacturers, succeeding here requires more than a strong product portfolio. It demands a deep understanding of the local landscape, from the procurement cycles of large government hospitals to the specific needs of a growing private healthcare sector. This article will explore the key dynamics shaping this expansion.

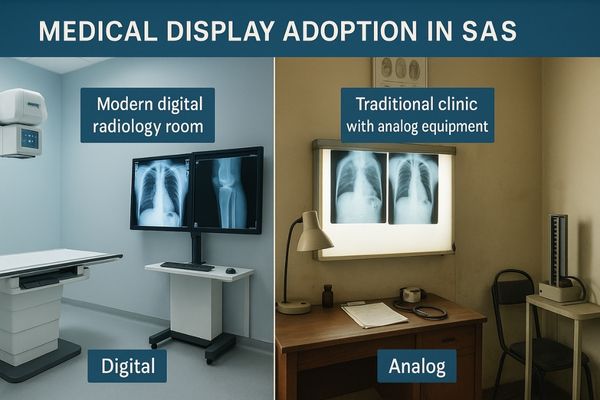

Current Landscape of Medical Display Adoption in Southeast Asia

Assuming a uniform market across Southeast Asia leads to flawed strategies. The region’s diverse technological adoption rates mean a single approach will fail to meet varying local needs.

The current landscape of medical display adoption in Southeast Asia is highly fragmented. It ranges from advanced digital hospitals in hubs like Singapore to facilities in developing areas that are just beginning their transition from analog to digital imaging.

In my experience, the most defining characteristic of the Southeast Asian market is its diversity. There is no single "Southeast Asian" standard for medical display adoption3. Instead, we see a spectrum of technological maturity. In highly developed urban centers like Singapore or Kuala Lumpur, hospitals often feature state-of-the-art PACS workstations and fully digital operating rooms that rival those anywhere in the world. These institutions demand high-resolution diagnostic and surgical displays. In contrast, in many rural or developing areas across Indonesia or the Philippines, healthcare facilities are still in the early stages of digitalization. Here, the transition from film-based X-rays to digital imaging4 is a major step forward, and the primary need is for reliable, entry-level clinical review monitors. I believe that understanding this variation is critical. A manufacturer must offer a product range that serves both ends of this spectrum, from basic clinical displays like the MD10C – 1MP Diagnostic Monitor for EMR and image review to advanced multi-modality solutions for specialized centers.

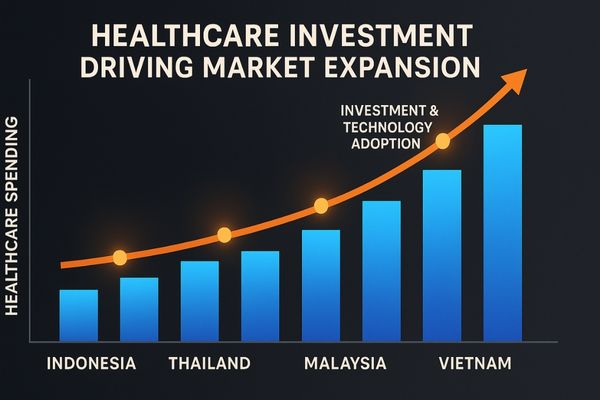

Key Factors Driving Market Expansion

Underestimating the growth drivers in Southeast Asia is a significant oversight. The region’s accelerated investment in healthcare infrastructure is creating powerful momentum for technology adoption.

Market expansion is primarily fueled by rising government healthcare expenditures, a growing middle class demanding better care, the expansion of medical tourism, and a widespread push from governments to implement digital health records and systems.

Several powerful factors are converging to fuel the expansion of the medical display market5 in this region. First, governments are making healthcare a national priority. We are seeing significant public investment in building new hospitals and modernizing existing ones, particularly in countries like Vietnam and Indonesia. This infrastructure development naturally includes the procurement of modern medical imaging equipment and the corresponding displays. Second, the region’s economic growth has created a larger middle class with higher disposable income and greater expectations for quality healthcare. This has fueled the growth of the private healthcare sector, which often competes by offering the latest technology. Third, countries like Thailand and Malaysia have established themselves as major hubs for medical tourism, attracting patients from around the world. To maintain their competitive edge, these hospitals must invest in world-class equipment, including high-performance medical displays. This ongoing push for quality makes a reliable diagnostic display like the MD26C – 24" Diagnostic Monitor a foundational component for new and upgraded radiology departments.

| Growth Driver | Impact on Medical Display Market |

|---|---|

| Government Investment | Large-scale public tenders for new hospital projects. |

| Growing Middle Class | Increased demand for private healthcare and advanced diagnostics. |

| Medical Tourism | Drives adoption of high-end, internationally recognized technology. |

| Digitalization Initiatives | Creates foundational demand for PACS and clinical review displays. |

Challenges Facing Medical Display Manufacturers

Entering this market without anticipating the challenges is a recipe for failure. Price pressures, logistical hurdles, and the need for local support can quickly undermine a market entry strategy.

Manufacturers face significant challenges in Southeast Asia, including intense price competition, navigating complex and varied national regulations, and the critical need to establish a reliable local network for sales, service, and technical support.

While the opportunities in Southeast Asia are substantial, so are the challenges. I have found that the market is extremely price-sensitive. Hospital procurement departments, especially in the public sector, operate under tight budgets. This creates a constant tension between the demand for high-quality, reliable medical displays and the pressure to choose the lowest-cost option. A key challenge is educating customers on the total cost of ownership6, where a more reliable display can be more cost-effective over its lifespan. Another significant hurdle is the fragmented regulatory environment. Each country has its own certification requirements, import duties, and tender processes, which requires significant local expertise to navigate. Perhaps the most critical challenge is service and support. A hospital cannot afford for a surgical display to fail. Success in this region is impossible without a strong local presence for installation, calibration, and responsive maintenance. This is why a cost-effective yet robust product like the MS220S – 22" FHD Endoscopic Monitor must be backed by an accessible and reliable local support team7 to gain trust.

Opportunities in Specific Countries and Healthcare Sectors

A broad, unfocused strategy for Southeast Asia will miss the mark. The real potential lies in identifying and targeting specific high-growth countries and healthcare sectors with tailored solutions.

Significant opportunities exist in advanced markets like Singapore for high-end specialty displays, while high-growth countries like Vietnam and Indonesia offer large-scale tenders for hospital-wide digital upgrades and new builds.

I believe a targeted approach is essential for capturing growth in Southeast Asia. The opportunities are not uniform. In Singapore, for instance, the market is mature and demands highly specialized, top-tier technology. The opportunities here lie in providing advanced displays for digital pathology8, 8MP or 12MP multi-modality radiology, and 5MP mammography, where clinical performance is the primary consideration. For these applications, a specialized product like the MD50C – 5MP Color Mammography Monitor9 meets the exacting standards of leading medical centers. In contrast, in rapidly developing nations like Vietnam and Indonesia, the opportunity is often in volume. Their governments are actively building new hospitals and pushing for nationwide digital health systems. This creates demand for thousands of primary diagnostic and clinical review monitors. The private sector is also booming, with new clinics and small hospitals opening frequently, creating a consistent need for reliable and affordable imaging equipment.

| Country | Key Opportunity Area | Required Product Focus |

|---|---|---|

| Singapore | High-end specialty care, medical research | 8MP/12MP Diagnostic, Digital Pathology Displays |

| Thailand | Medical Tourism, Private Hospitals | 4K Surgical Monitors, Advanced Diagnostic Displays |

| Vietnam | Public Healthcare Infrastructure Expansion | Primary Diagnostic & Clinical Review Monitors (Volume) |

| Indonesia | Nationwide Digitalization, Private Sector Growth | PACS Workstation Displays, Endoscopy Monitors |

Future Outlook for Medical Displays in Southeast Asia

Viewing the market with a short-term perspective misses the structural shifts underway. Future growth will be defined by large-scale projects and deeper digital integration across the region.

The future outlook for medical displays in Southeast Asia is highly positive. Growth will be sustained by large-scale government healthcare projects, the expansion of multinational hospital groups, and the increasing adoption of teleradiology and integrated health networks.

Looking ahead, I am very optimistic about the long-term trajectory of the medical display market10 in Southeast Asia. The growth we see today is not a temporary spike; it is part of a fundamental transformation of the region’s healthcare landscape. I foresee two key drivers shaping the future. First, the expansion of major private hospital groups will be a significant factor. These organizations often standardize their equipment procurement across multiple countries, creating large, recurring opportunities for trusted technology partners. Second, government-led digital health initiatives will continue to mature. This goes beyond basic PACS implementation and will move toward integrated regional health networks and teleradiology services11. Teleradiology, in particular, will connect specialists in major cities with patients in remote areas, creating a need for calibrated, high-quality diagnostic displays at both ends of the connection. This trend toward larger, more integrated networks will favor displays that offer robust performance and seamless integration, such as the MS430PC – 43" 4K Surgical Monitor, which is ideal for the modern, connected operating rooms being built by these large hospital groups.

Conclusion

The Southeast Asian medical display market is a region of great promise. Its expansion is fueled by strong investment and a clear demand for better healthcare, offering significant opportunities for those who can navigate its unique challenges. To explore opportunities in Southeast Asia’s medical display market, contact Reshin at martin@reshinmonitors.com.

-

Explore this link to understand the latest trends and innovations in the medical technology industry, crucial for navigating Southeast Asia’s market. ↩

-

This resource provides insights into the evolving healthcare infrastructure in Southeast Asia, essential for stakeholders in the medical field. ↩

-

Explore this link to understand the diverse trends in medical display adoption across Southeast Asia, crucial for manufacturers and healthcare providers. ↩

-

This resource will provide insights into how digital imaging is revolutionizing healthcare practices in Southeast Asia, essential for industry stakeholders. ↩

-

Explore this link to understand the latest trends and innovations shaping the medical display market, crucial for healthcare advancements. ↩

-

Understanding the total cost of ownership can help you make informed decisions about medical displays, ensuring long-term savings. ↩

-

A local support team ensures timely service and maintenance, crucial for the reliability of medical displays in hospitals. ↩

-

Explore this link to understand how advanced displays enhance digital pathology, improving diagnostics and patient outcomes. ↩

-

Learn about the 5MP Color Mammography Monitor’s features and how it meets the needs of modern medical facilities. ↩

-

Explore this link to understand the dynamics and growth potential of the medical display market in Southeast Asia. ↩

-

Discover how teleradiology services are bridging the gap in healthcare access for remote patients. ↩