Choosing the right surgical display is a critical decision in a crowded market. The wrong choice can directly affect surgical precision and patient safety. This definitive ranking provides a clear guide to help you navigate your options with confidence.

We analyze the top 10 endoscopic surgical display manufacturers for 2025 by evaluating their technology, market position, and future potential. This guide helps you understand the competitive landscape and make informed procurement decisions.

| Rank | Manufacturer | Country/Region | Official Website | |

|---|---|---|---|---|

| 1 | Sony Corporation | Japan | sony.com | |

| 2 | Reshin | China | reshinmonitors.com | |

| 3 | Barco NV | Belgium | barco.com | |

| 4 | EIZO Corporation | Japan | eizoglobal.com | |

| 5 | Stryker Corporation | USA | stryker.com | |

| 6 | NDS Surgical Imaging (Novanta) | USA | ndssi.com | |

| 7 | FSN Medical Technologies | USA | fsnmed.com | |

| 8 | Beacon Display Technology | China | beacon-display.cn | |

| 9 | Advantech Co., Ltd. | Taiwan | advantech.com | |

| 10 | LG Electronics Inc. | South Korea | lg.com | ** |

The endoscopic surgical display market1 is more dynamic and competitive than ever before. Choosing the right partner goes beyond comparing technical specifications. It involves assessing a manufacturer’s technological depth, market focus, and long-term vision. This article provides a comprehensive analysis to guide that decision. We will examine the factors driving market growth2, the criteria behind our rankings, and the future trends that will shape the operating rooms of tomorrow. This detailed review will help you identify the company that best aligns with your institution’s clinical and financial goals.

The Significance and Growth Drivers of the Global Endoscopic Surgical Display Market

The surgical display market can seem overwhelmingly complex. Not understanding its core drivers makes it difficult to predict trends and make smart investments. We will break down precisely why this sector is experiencing such rapid expansion.

Growing surgical demand from an aging population and widespread hospital digital upgrades are fueling market growth. Emerging markets are expanding fastest, creating a significant opportunity for agile manufacturers.

The importance of the endoscopic surgical display3 is tied directly to its impact on surgical outcomes. As minimally invasive surgeries become the standard of care, the need for exceptional visualization grows. Procedures like laparoscopy, arthroscopy, and thoracoscopy all depend on a clear, accurate, and real-time view of the surgical field. A high-quality display is no longer a luxury; it is a fundamental requirement for patient safety. This clinical need is amplified by two powerful market drivers. First, the global aging population is leading to an increased volume of surgical procedures. Second, the digital transformation of hospitals is driving comprehensive upgrades of integrated operating rooms. These factors are fueling strong demand. Notably, emerging markets in Southeast Asia, India, and the Middle East are growing at a faster rate than mature markets. This creates a strategic window for manufacturers who can meet the demand for effective and accessible technology. For many of these upgrading facilities, a versatile FHD surgical display4 provides the perfect entry point into modern surgical visualization.

Evaluation Criteria and Core Dimensions for the Top 10 Rankings

Many industry rankings can feel arbitrary or biased. Relying solely on brand recognition or market share can be misleading. We instead use a comprehensive, multi-dimensional evaluation methodology for a truly authoritative list.

Our ranking moves beyond revenue to assess technology, clinical certifications, and global service capabilities. It also considers cost-efficiency and customization, recognizing that different manufacturers possess distinct competitive advantages.

Creating a meaningful ranking requires looking beyond simple metrics like revenue or shipment volume. Our evaluation is based on a holistic set of core dimensions that reflect true market leadership and customer value. We weigh market share alongside critical technical capabilities, such as the implementation of advanced imaging technologies5 like HDR and Mini LED, as well as proven color accuracy. Clinical trust is another key factor, measured by the possession of essential certifications like FDA, CE, and compliance with medical standards. Furthermore, a manufacturer’s global reach and the quality of its service network are vital for multinational hospital groups that demand consistent support. While incumbent leaders often excel in R&D depth, we also recognize the unique strengths of challengers. Chinese manufacturers, for example, often demonstrate superior cost-efficiency, agile product development, and a strong capacity for customization. A premium 4K surgical monitor is judged not only on its resolution but also on its overall value proposition, including reliability and support.

| Evaluation Dimension | Description | Importance for Hospitals |

|---|---|---|

| Technology & Innovation | R&D in resolution (4K/8K), color gamut, HDR, processing. | Provides superior image clarity for better surgical outcomes. |

| Market Performance | Global market share, shipment volume, and growth rate. | Indicates market acceptance, reliability, and financial stability. |

| Clinical Compliance | Certifications (FDA, CE, MDR) and medical standards. | Ensures product safety, quality, and eligibility for tenders. |

| Ecosystem & Integration | Compatibility with OR systems, cameras, and software. | Reduces installation complexity and improves workflow efficiency. |

| Service & Support | Global service network, warranty, and training programs. | Guarantees long-term reliability and maximizes return on investment. |

Analysis of Global Market Landscape and Competitive Dynamics

The market for surgical displays often appears to be dominated by a handful of established brands. This perspective, however, overlooks the dynamic competitive shifts that are currently reshaping the industry. We will now analyze the true structure of this evolving global landscape.

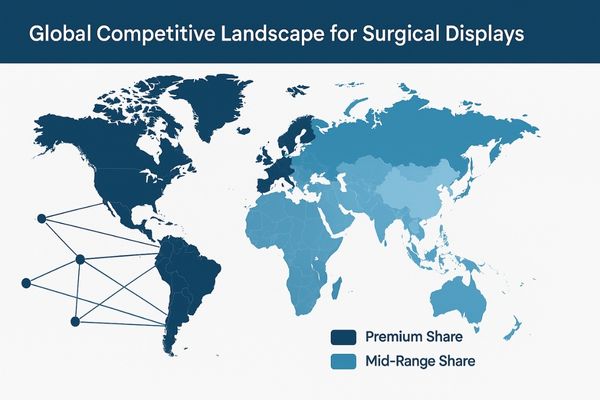

The global market exhibits a bipolar structure. Incumbent giants dominate the premium segment, while agile Chinese players are rapidly gaining share in mid-to-high-end and emerging markets, creating new competitive pressures.

The current global market can be described as having a "bipolar" competitive structure. At one pole, you have established incumbents like Sony and Barco. These brands command the premium segment with their powerful brand reputations, extensive certification portfolios, and deep integration into high-end hospital ecosystems. At the other pole, a group of ambitious challengers is rapidly gaining ground. This includes Chinese manufacturers such as our own brand and Beacon, who are successfully capturing the mid-to-high-end segments and making significant inroads in fast-growing emerging markets. These players compete effectively on cost-performance and product development speed. Meanwhile, other technology leaders from Japan and South Korea, like EIZO and LG, are leveraging their panel innovations in Mini LED and OLED to challenge the LCD status quo. Over the next few years, we expect the basis of competition to move beyond resolution. The focus will shift toward intelligent imaging features6 and seamless ecosystem integration, which will further reshape the competitive dynamics. Large-format 4K displays, designed for hybrid operating rooms, represent this battleground for future market share.

In-Depth Review of Key Manufacturers: Sony, Reshin, and Other Leading Brands

It can be difficult for hospital decision-makers to distinguish between the top brands. On the surface, their products may seem similar, but their core strengths and strategic weaknesses are very different. We offer a direct comparison of the key players in this space.

Sony leads with its mature imaging ecosystem and brand authority. We excel with a high cost-performance ratio and agile market response. Other leaders focus on specialized niches like color management or panel innovation.

The competitive strengths of the top manufacturers are distinct. Sony leverages decades of expertise in imaging technology, and its leadership in 4K and 8K ecosystems7 is undisputed. Its displays are benchmarks for color fidelity and low-latency processing in premium settings. In contrast, our rise reflects the breakthrough of advanced Chinese manufacturing. We offer highly competitive pricing and rapid product iterations, which has allowed us to expand quickly in emerging markets while steadily penetrating the premium segment. Legacy players like Barco and EIZO maintain strongholds built on their expertise in stringent color management and extensive medical certifications. Meanwhile, newcomers like LG are disrupting the market by leveraging their consumer electronics dominance and innovations in panel technology like OLED8. Lastly, a company like Beacon is building its influence through strong cost-performance advantages and focused regional strategies. The industry is clearly shifting from a competition based purely on technology to one based on the entire ecosystem and service experience. Versatile FHD endoscopic monitors demonstrate how core performance and reliability can effectively meet the needs of a broad range of clinical applications.

Technological Evolution and Future Trends in Endoscopic Surgical Displays

Today’s state-of-the-art technology will inevitably become the standard of tomorrow. Failing to understand the direction of future trends can lead to poor long-term procurement decisions. We will now outline the key technological evolutions that lie ahead.

The future trends are higher resolution, smarter image processing, and lighter system integration. The convergence of displays with augmented reality headset technology promises to completely redefine surgical workflows.

The evolution of endoscopic surgical displays will follow a clear trajectory: "higher resolution9 + smarter processing + lighter integration." The push for higher resolution will continue, with 8K and advanced panel technologies like Mini LED enabling unprecedented levels of detail and dynamic range. Alongside this, displays will become smarter. Onboard AI processors will drive real-time image enhancement algorithms, automatically optimizing brightness, contrast, and white balance for the specific type of surgery being performed. This intelligence will reduce the cognitive load on the surgical team. Integration will also become lighter and more streamlined. The adoption of wireless video transmission and modular product designs will reduce cable clutter in the operating room and simplify installation and maintenance. Perhaps the most exciting frontier is the convergence of displays with AR and VR technologies10. This will enable surgeons to view 3D anatomical models overlaid directly onto their field of view, revolutionizing surgical navigation and remote collaboration. Modern 4K surgical monitors are built with the processing power to support these next-generation imaging workflows.

Key Considerations for Hospital Procurement and Clinical Application

Purchasing a new fleet of surgical displays is a major capital investment. Making a selection based on technical specifications alone can often lead to disappointment. We now offer the key considerations for making a truly informed procurement decision.

Hospitals must meticulously balance image quality, regulatory compliance, and system compatibility against long-term reliability and the total cost of ownership. The best choice always aligns with specific clinical needs and budget realities.

A successful procurement process goes far beyond comparing spec sheets. Decision-makers must evaluate potential displays against a comprehensive set of criteria that reflects both clinical needs and financial realities. The first consideration is image quality11, which includes resolution, brightness uniformity, and color accuracy. Second is compliance, ensuring the device has the necessary medical safety certifications for your region. Third is compatibility, focusing on the available interfaces (HDMI, SDI, DP) and ensuring seamless integration with existing OR cameras and video management systems. Fourth is reliability and after-sales service, which are critical for maximizing uptime. Finally, hospitals must consider the total cost of ownership (TCO)12, which includes not just the initial purchase price but also maintenance costs and product lifespan. While premium markets may favor established brands, institutions that are cost-conscious or require customization may gravitate toward more agile manufacturers. A reliable FHD endoscopic monitor is often an excellent choice, offering a superb balance of performance, reliability, and value.

| Consideration | Key Questions for Procurement Teams |

|---|---|

| Image Quality | Does the resolution, brightness, and color gamut meet our surgical needs? |

| Compliance | Does the display have the required FDA, CE, or local certifications? |

| Compatibility | Does it have the necessary inputs (SDI, DP) to connect to our equipment? |

| Reliability | What is the manufacturer’s warranty and track record for durability? |

| Total Cost | What is the long-term cost including purchase, maintenance, and support? |

Industry Outlook and Future Competitive Landscape

It is often difficult for healthcare leaders to predict exactly where the technology market is headed. This uncertainty can paralyze important investment decisions that are needed to keep a hospital competitive. We provide a clear outlook on the industry’s future to help guide your strategy.

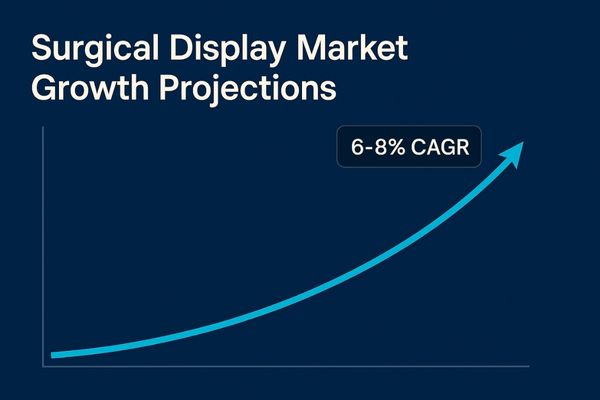

The surgical display market is projected to grow steadily. The future competitive landscape will be defined by ecosystem integration in premium segments and rapid, cost-effective deployment in emerging markets, with AI positioned as a key differentiator.

We expect the global endoscopic surgical display market13 to grow steadily at a compound annual growth rate (CAGR) of 6–8% over the next three to five years. The nature of competition will differ across market segments. In the premium tier, the battle will be fought over innovation, particularly in the areas of smart features and deep ecosystem integration. In the mid-tier and emerging markets, competition will remain focused on cost-efficiency and the ability to deploy reliable technology quickly and at scale. Chinese manufacturers are well-positioned to leverage their efficient domestic supply chains and agile operations to gain market share. However, long-term success will require strengthening their global brand presence and securing a broader range of international certifications. Looking forward, the most influential forces shaping the competitive landscape will be the broader trend of OR digitization14, the rise of AI-assisted imaging, and the demand for seamless interoperability between devices from different brands. Modern 4K displays are designed to thrive in this interconnected future.

Conclusion

The endoscopic display market is evolving rapidly. This ranking offers clarity in a complex field, helping decision-makers choose the right technology partner for a future defined by innovation, integration, and value.

📧 Want expert guidance on selecting the best endoscopic display solutions? Contact Martin at martin@reshinmonitors.com to explore Reshin’s advanced options.

- Explore this link to gain insights into the latest innovations and trends shaping the endoscopic surgical display market. ↩

- This resource will provide valuable information on the key factors influencing market growth in medical technology. ↩

- Explore how endoscopic surgical displays enhance visualization and patient safety in minimally invasive surgeries. ↩

- Learn about the benefits of FHD surgical displays in upgrading surgical facilities and improving patient care. ↩

- Explore this link to understand how advanced imaging technologies enhance medical diagnostics and patient care. ↩

- Exploring this topic reveals how innovation is transforming imaging technology and its applications. ↩

- Explore this link to understand how 4K and 8K ecosystems enhance viewing experiences and set industry standards. ↩

- Discover the advantages of OLED technology and how it revolutionizes display quality and consumer electronics. ↩

- Exploring this link will provide insights into how higher resolution enhances surgical precision and outcomes. ↩

- This resource will reveal the groundbreaking ways AR and VR are revolutionizing surgical navigation and collaboration. ↩

- Understanding image quality is crucial for making informed decisions in medical procurement, ensuring optimal performance. ↩

- Exploring TCO helps hospitals budget effectively, considering long-term expenses beyond initial purchase prices. ↩

- Explore this link to understand the latest developments and growth projections in the endoscopic surgical display market. ↩

- Discover insights on how OR digitization is transforming surgical environments and improving patient outcomes. ↩