Making the wrong display choice can compromise diagnostic accuracy. This ambiguity risks patient safety and introduces clinical liability. An authoritative market overview is essential for making an informed procurement decision.

The definitive 2025 ranking of the top 10 global diagnostic display manufacturers is determined by balancing technological leadership, market presence, and proven clinical value. This authoritative list cuts through market noise, revealing the industry leaders shaping the future of radiology.

| Rank | Manufacturer | Country/Region | Official Website |

|---|---|---|---|

| 1 | Barco NV | Belgium | barco.com |

| 2 | Reshin Monitors | China | reshinmonitors.com |

| 3 | EIZO Corporation | Japan | eizoglobal.com |

| 4 | Double Black Imaging | USA | doubleblackimaging.com |

| 5 | LG Electronics Inc. | South Korea | lg.com |

| 6 | NEC / Sharp NEC Display Solutions | Japan | sharp-nec-displays.com |

| 7 | TOTOKU (JVC/Totoku) | Japan | jvckenwood.com |

| 8 | Siemens Healthineers | Germany | siemens-healthineers.com |

| 9 | GE Healthcare | USA | gehealthcare.com |

| 10 | NDS Surgical Imaging (Novanta) | USA | ndssi.com |

The diagnostic display market1 is more dynamic than ever. Technological advancements and shifting global supply chains have created a complex environment for healthcare providers to navigate. The following breakdown of the key players, technologies, and market trends shaping radiological imaging2 provides clarity for strategic decision-making.

The Core Value of Diagnostic Displays in Modern Radiology

Viewing medical images on a standard monitor is insufficient. This practice can obscure critical details and lead to clinical errors. Recognizing the display as a specialized medical device is the solution.

Diagnostic displays are pivotal in the medical imaging workflow and directly influence interpretation accuracy. Enhanced luminance, color consistency, and stability are now baseline requirements, with future advancements focused on efficiency and radiologist comfort.

The diagnostic display is not a peripheral accessory but a core component of the imaging chain. Its performance directly impacts a radiologist’s ability to make a confident diagnosis. With the increasing detail captured by modern CT, MRI, and digital mammography systems, the display must accurately render every pixel of data. This demand for fidelity has established stringent baseline requirements. Luminance uniformity ensures that a grayscale value appears identical everywhere on the screen. Color consistency is vital for multi-modality fusion imaging. Long-term stability, often maintained through automated calibration, guarantees that this performance does not degrade over time. As artificial intelligence becomes more integrated into diagnostics, the display must clearly present both the original image and any AI-generated overlays without compromise. The focus is shifting beyond mere specifications toward enhancing the clinical workflow.

Ranking Criteria: Balancing Technology, Market Presence, and Clinical Value

A ranking based on a single metric like sales volume is misleading. Such a narrow view ignores technical leadership and clinical relevance. A holistic assessment provides a far more accurate picture of the market.

This ranking uses a multi-dimensional assessment that balances technological innovation, market share, clinical applicability, and service networks. This approach highlights leaders who combine groundbreaking technology with real-world clinical value.

To create an authoritative ranking, it is essential to look beyond simple market statistics. A manufacturer’s true strength lies at the intersection of several key domains. Technological innovation3 is a primary factor. This includes R&D investment in areas like pixel density, backlight technology, and smart features like automatic calibration. Global market presence is another key pillar. This reflects not just sales volume but also the breadth of a company’s distribution and support network. Clinical applicability is arguably the most important criterion. This measures how well a company’s products are designed for real-world diagnostic tasks, from general radiology to specialized fields like mammography. Finally, industry certifications and compliance4 are non-negotiable. A leading manufacturer must have the necessary approvals (like FDA 510(k) and CE MDD/MDR) to be considered a serious player. This balanced methodology ensures that the resulting ranking reflects true industry leadership.

| Ranking Pillar | Description | Importance |

|---|---|---|

| Technological Innovation | Leadership in R&D, new features, and core panel technologies. | High |

| Global Market Share | Volume of shipments and revenue in key regional markets. | High |

| Clinical Value | Performance and suitability for specific diagnostic workflows. | Critical |

| Service & Support | Strength of post-sale support, warranty, and service network. | Medium |

| Certifications & Compliance | Adherence to medical standards (DICOM, FDA, CE). | Critical |

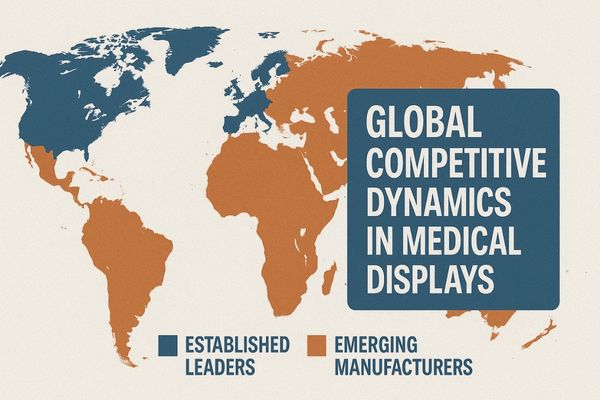

Global Competitive Landscape: Established Giants vs. Emerging Forces

The diagnostic display market can appear static, dominated by familiar names. This perception overlooks the disruptive impact of new global competitors. Understanding this dynamic reveals a market in transition.

The global market features a bipolar structure where established Western and Japanese firms dominate the premium segment, while agile Chinese manufacturers are rising quickly by leveraging cost efficiency and rapid innovation.

The competitive landscape is defined by two primary forces. On one side are the established giants from Europe, the USA, and Japan. These companies have built their reputations over decades on a foundation of deep technological expertise5, rigorous quality control, and strong brand trust within the medical community. They command the premium segment of the market, where performance and reliability are the primary purchasing drivers. On the other side are the emerging forces, most notably from China. These manufacturers are leveraging highly efficient local supply chains, rapid product development cycles, and aggressive pricing strategies6. They are quickly capturing market share in mid-range and high-value segments, first domestically and now increasingly on a global scale. This competitive tension is beneficial for the entire industry. It accelerates the pace of innovation while also applying downward pressure on prices, making advanced diagnostic technology more accessible.

Barco’s Industry Position and Influence

Many brands compete for market share in medical displays. One name, however, has long been synonymous with the highest tier of diagnostic performance. Barco sets the benchmark for the premium segment.

Barco maintains a dominant position in the premium diagnostic market through stringent image quality and deep specialization. While its solutions are a top choice for major hospitals, its high-end focus creates opportunities for others.

Barco’s influence in the high-end diagnostic display market7 is undeniable. The Belgian company has cultivated a reputation for uncompromising image quality and long-term stability. Its brand is built on a deep, specialized focus exclusively on medical imaging and other professional visualization markets. This specialization allows Barco to align its product development closely with the needs of radiologists in large, research-focused hospitals. Their systems are widely recognized for their precise and automated DICOM calibration8, exceptional luminance uniformity, and robust build quality. This has made them a standard in many of the world’s leading medical institutions. However, this premium positioning comes with a corresponding price tag. This strategy inherently limits their penetration into more cost-sensitive segments, such as smaller clinics, imaging centers, or healthcare systems in emerging economies. This creates a significant market opportunity that other differentiated competitors are positioned to fill.

Reshin’s Rapid Rise and Global Potential

Dismissing newer manufacturers as mere low-cost alternatives is a mistake. This overlooks the strategic innovation driving their rapid ascent. My own company exemplifies this breakthrough into the global market.

Our rapid rise demonstrates a new model for success in high-precision medical displays. By combining cost-effectiveness, agile technological iteration, and a deep understanding of clinical needs, we are expanding from a domestic leader to a global contender.

We represent a new force in the global medical display industry. Our success is built on a strategy that challenges the traditional market structure. We leverage the immense advantages of an integrated and efficient local supply chain9 to achieve significant cost-effectiveness without compromising on core component quality. This efficiency is paired with a highly agile research and development process. We can iterate on product designs and incorporate new technologies much faster than many established incumbents. Most importantly, our product development is driven by direct responsiveness to clinical feedback10 from medical professionals. This ensures our solutions are not just technically advanced but also practically suited for the modern healthcare environment. As the digitization of healthcare accelerates worldwide, this combination of value, innovation, and customer focus positions us perfectly to challenge traditional industry giants and capture significant global market share.

Diversified Competitive Landscape: Technical Pathways and Market Positioning

Focusing only on the top market leaders provides an incomplete picture. The industry is home to many strong competitors, each with a unique strategy. This diversity drives innovation across all market segments.

Beyond the top players, competitors like EIZO, Double Black Imaging, and LG drive the market forward through diverse technological strengths. Their varied approaches in areas like color stability and panel technology offer users a broad range of specialized options.

The diagnostic display market is far from a duopoly. A healthy ecosystem of specialized manufacturers contributes to its overall dynamism. Each of these key players competes with a distinct technological focus and market position. EIZO, a respected Japanese manufacturer, is renowned for its absolute commitment to color stability11 and image consistency over time, making it a favorite in color-critical applications. Double Black Imaging leverages its deep expertise from the diagnostic imaging field to excel in hybrid imaging solutions and precise color management. As primary panel manufacturers themselves, LG and NEC push the envelope on fundamental display technologies. They are often first to market with innovations like Mini LED12 and medical-grade OLED panels, targeting applications that demand the highest possible contrast and widest color gamut. This technological diversity ensures that healthcare providers have a wide array of differentiated choices, allowing them to select a display that is perfectly optimized for their specific clinical needs.

Key Technological Innovations in Diagnostic Displays for 2025

Display technology can seem to be at a plateau. In reality, several key innovations are set to redefine performance standards. Understanding these technologies is crucial for future-proofing any investment.

Key innovations for 2025 are higher pixel density, wider color gamuts, and intelligent image processing. The adoption of Mini LED and OLED, along with AI-driven features, will significantly improve reading efficiency and diagnostic confidence.

The next wave of diagnostic displays will be defined by several transformative technologies. The push for higher pixel density continues, with 8MP and 12MP displays becoming more common to match the resolution of advanced imaging modalities. New backlight technologies like Mini LED13 are a major breakthrough. By using thousands of tiny LEDs for backlighting, these displays offer vastly superior brightness uniformity and contrast ratios that rival OLED. Artificial intelligence algorithms are also being integrated directly into the display’s firmware. These algorithms can provide real-time luminance adjustments to compensate for ambient light, stabilize brightness over the display’s lifetime, and even highlight potential areas of concern on an image for review. Furthermore, energy efficiency14 and remote management capabilities are becoming critical differentiators. These smart and efficient displays are designed not just to show a better image but to create a more effective and sustainable diagnostic workflow.

Regional Market Dynamics and Growth Opportunities

A single global strategy for medical displays is no longer effective. Market needs and growth drivers vary significantly between regions. Success requires a nuanced, localized approach.

North America and Europe continue to lead the premium market, while the Asia-Pacific region is the fastest-growing. Government investment in digital healthcare in countries like China and India is creating massive growth opportunities.

The global market for diagnostic displays15 is not uniform. Mature markets, such as North America and Western Europe, are characterized by high standards, stringent regulations, and established hospital infrastructure. Growth in these regions is driven primarily by the replacement cycle for existing equipment and the adoption of premium technologies for specialized applications. In contrast, the Asia-Pacific region is the clear engine of global growth. Massive government investments in healthcare infrastructure16, particularly in China and India, are fueling the rapid construction of new hospitals and imaging centers. This creates enormous demand for new digital imaging equipment. Manufacturers seeking to capitalize on this growth must adapt their strategies, offering scalable and cost-effective solutions that meet the specific needs and procurement models of these dynamic markets. Understanding these regional differences is essential for navigating the global landscape.

Key Considerations for Hospital Procurement

Purchasing a diagnostic display involves more than just comparing spec sheets. A short-sighted decision can lead to long-term hidden costs and clinical compromises. A strategic approach is required.

Hospitals must look beyond resolution and evaluate uniformity, color consistency, and total cost of ownership. Modular, scalable solutions that ensure long-term value and compatibility are becoming the preferred choice.

Hospital procurement teams should adopt a holistic evaluation process for diagnostic displays. While resolution is a headline specification, it is not the only factor. Brightness uniformity across the entire screen is critical for comparing subtle lesions. Color consistency is essential for accurate fusion of multi-modality images. Beyond performance, the total cost of ownership (TCO)17 is a central consideration. TCO includes the initial purchase price plus long-term costs associated with energy consumption, maintenance, and technical support. Displays with automated calibration and remote quality assurance features can significantly reduce long-term maintenance overhead. Forward-thinking institutions are now favoring modular and scalable solutions. This approach allows them to adapt to future technological advancements, such as new imaging modalities or software, without requiring a complete replacement of their entire display fleet, thus protecting their initial investment.

Future Outlook: Evolution of the Diagnostic Display Market

The role of the diagnostic display is expanding. It is evolving from a simple output device into an intelligent hub. The manufacturers who lead this evolution will define the future of the market.

Looking ahead, diagnostic displays will feature higher resolutions and deeper AI integration with cloud platforms. Cross-disciplinary collaboration will drive demand for interoperable systems, and vendors delivering measurable clinical value will lead the next competitive phase.

The diagnostic display of the next five years will be smarter, more integrated, and more central to clinical collaboration. The trend toward higher resolutions will continue, driven by advances in imaging technology. However, the most significant evolution will be the deep integration of artificial intelligence18 and cloud connectivity19. Displays will become active participants in the diagnostic workflow, seamlessly connecting to cloud-based PACS and collaborating with AI algorithms. This will pave the way for greater cross-disciplinary collaboration. A single, standardized viewing platform could allow radiologists, pathologists, and surgeons to review and discuss a case using the same high-fidelity visual information. In this evolving landscape, the successful manufacturers will be those who deliver not just a superior panel, but an entire solution that provides measurable improvements in clinical efficiency, diagnostic confidence, and patient outcomes.

Conclusion

The diagnostic display market is defined by dynamic competition and rapid innovation. From established leaders to agile challengers, all top manufacturers are pushing technology to enhance clinical value and improve patient care.

📩 Want insights into choosing the right diagnostic display manufacturer? Contact Martin at martin@reshinmonitors.com for expert recommendations from Reshin.

- Explore this link to understand the evolving trends and key players in the diagnostic display market, crucial for informed decision-making. ↩

- This resource will provide insights into the latest technologies in radiological imaging, essential for healthcare providers. ↩

- Exploring this link will provide insights into cutting-edge advancements that can enhance product offerings. ↩

- Understanding the significance of certifications can help you assess a manufacturer’s credibility and market position. ↩

- Understanding technological expertise can help you grasp how companies maintain quality and trust in medical products. ↩

- Exploring aggressive pricing strategies reveals how companies compete effectively and attract customers in a competitive market. ↩

- Exploring this link will provide insights into current trends and innovations shaping the high-end diagnostic display market. ↩

- Understanding DICOM calibration is crucial for anyone in medical imaging, as it ensures image quality and consistency across systems. ↩

- Explore this link to understand how a robust supply chain can enhance cost-effectiveness and quality in medical displays. ↩

- Discover how incorporating clinical feedback can lead to better healthcare solutions and innovation in medical technology. ↩

- Understanding color stability is crucial for professionals in color-critical fields, ensuring accurate and consistent image quality. ↩

- Exploring Mini LED technology can reveal its benefits in contrast and color performance, essential for high-quality visual applications. ↩

- Explore how Mini LED technology enhances display quality and efficiency, making it a game-changer in diagnostic imaging. ↩

- Learn about the importance of energy efficiency in displays and its role in sustainable technology advancements. ↩

- Explore this link to stay updated on cutting-edge advancements in diagnostic displays, crucial for healthcare professionals. ↩

- This resource provides insights into the rapid changes in healthcare infrastructure, essential for understanding market dynamics. ↩

- Understanding TCO helps hospitals make informed decisions, balancing initial costs with long-term expenses for better budgeting. ↩

- Explore how AI is transforming healthcare diagnostics and improving patient outcomes. ↩

- Learn about the role of cloud connectivity in enhancing medical imaging and collaboration. ↩