The medical display market is often opaque, making it difficult for hospital administrators and clinicians to identify the most reliable and innovative manufacturers in a crowded global field. This 2025 overview ranks the top 10 medical display manufacturers worldwide based on market presence, innovation, and compliance, helping buyers compare the best medical display manufacturers globally.

According to market presence, innovation, and compliance, the Top 10 manufacturers are:

- Barco (Belgium)

- Reshin (China)

- EIZO (Japan)

- Sony (Japan)

- NEC (Japan)

- LG Electronics (South Korea)

- FSN Medical (South Korea)

- Advantech (Taiwan)

- Quest International (USA)

- Siemens Healthineers (Germany)

The landscape of medical-grade display technology1 is undergoing a significant transformation, driven by advancements in imaging modalities, the rise of artificial intelligence, and evolving regulatory standards. For healthcare institutions worldwide, selecting the right display is a critical decision that directly impacts diagnostic accuracy, clinical workflow efficiency, and patient outcomes. Unlike the consumer electronics market, this specialized industry is defined by stringent technical requirements, long product lifecycles, and a deep understanding of clinical needs. This article provides a comprehensive overview of the global medical-grade display market2 in 2025, based on our analysis and experience supporting hospital display projects, detailing the ranking methodology used to identify the top 10 manufacturers and profiling the leaders who are shaping the future of medical imaging visualization.

Global Market Landscape of Medical-Grade Displays

The global demand for high-fidelity medical imaging is growing relentlessly. This trend places increasing pressure on display technology to keep pace, driving both market growth and technological innovation.

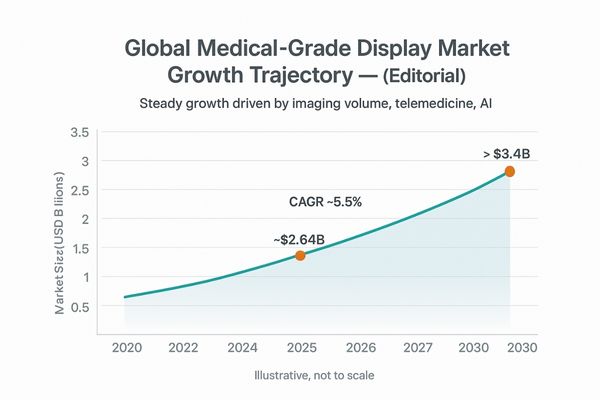

The global medical-grade display market is valued at approximately USD 2.64 billion in 2025, with projected growth fueled by rising imaging volumes, telemedicine, and AI-driven analytics.

In 2025, the medical-grade display market3 represents a highly specialized and robust segment of the healthcare technology industry, with an estimated value of USD 2.64 billion. Projections indicate a strong growth trajectory, with market analysts forecasting it to exceed USD 3.4 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 5.5% according to 2024–2025 market estimates. This expansion is not arbitrary; it is propelled by fundamental shifts in modern medicine. The volume of diagnostic imaging procedures, particularly complex modalities like CT, MRI, and 3D endoscopy, continues to rise globally. Each of these requires displays with exceptional resolution, luminance, and color fidelity to be clinically effective. Furthermore, two powerful trends are accelerating demand: the integration of telemedicine and remote diagnostic platforms4, which rely on consistent, calibrated displays for remote consultations, and the expanding use of AI-based imaging analytics, which often highlight subtle abnormalities that are only perceptible on a high-performance monitor. The market structure is notably concentrated, with the top three global players—Barco, EIZO, and Reshin—collectively holding a majority share. This underscores the high barriers to entry created by strict regulatory hurdles and deep technological requirements.

Ranking Methodology and Evaluation Criteria

A credible ranking cannot be based on sales figures alone. It must reflect a manufacturer’s ability to innovate, comply with regulations, and meet the complex needs of clinicians.

The 2025 ranking is based on a multi-factor methodology, weighing market presence, product portfolio breadth, regulatory compliance, and technological innovation, including advancements in AI and display panel technology.

To provide a comprehensive and objective assessment of the global leaders, the 2025 ranking was developed using a weighted, multi-factor methodology. The evaluation criteria were designed to capture a holistic view of each company’s capabilities and market position. Key factors included:

- Market Presence and Distribution5: This considers global sales volume, regional market share, and the strength of a company’s distribution and service networks.

- Product Portfolio Breadth: Companies were evaluated on the depth and diversity of their product lines, including diagnostic displays (radiology, mammography), surgical monitors (endoscopy, C-arms), and clinical review displays.

- Regulatory Compliance: A critical component, this assesses a manufacturer’s adherence to essential standards like DICOM Part 14 GSDF, as well as holding major certifications such as CE-MDR and FDA 510(k) clearance.

- Technological Innovation6: Significant weight was given to investment in research and development. This includes advancements in display technology (OLED, Mini-LED), visualization features (HDR), and the integration of AI-assisted diagnostic tools.

- Clinical and Ergonomic Solutions: The ability to provide tools that improve clinical workflows, such as automatic calibration and user-friendly software, and features that reduce clinician fatigue was also a key consideration.

This methodology ensures the ranking reflects not just current market leadership but also a company’s readiness for future industry trends. The assessment combines publicly available market data, manufacturers’ published specifications, and hands-on evaluation from engineers working on imaging and OR integration projects.

Profiles of Leading Manufacturers in 2025

The top of the market is characterized by a mix of long-established industry titans and dynamic, fast-growing challengers who are reshaping the competitive environment.

The top 10 is led by Barco, Reshin, and EIZO, followed by other global players like Sony, LG, and Siemens. This mix represents both established dominance and disruptive regional growth among leading medical monitor manufacturers.

The 2025 ranking reveals a fascinating blend of companies, each with distinct strengths and market strategies. At the apex, Barco (Belgium) continues its long-standing leadership, dominating the premium diagnostic and surgical display segments with its unparalleled brand reputation and technological prowess. Following closely is Reshin (China), which has successfully combined strong cost-performance with robust quality and localized service, enabling it to capture significant market share globally. Next is EIZO (Japan), a company renowned for the exceptional stability, longevity, and color accuracy of its multi-modality diagnostic displays. The rest of the top 10 includes a diverse group of powerful players. Sony (Japan) and LG (South Korea) leverage their consumer electronics expertise to excel in the surgical display market. FSN Medical (South Korea) and Advantech (Taiwan) are noted for their focus on integrated and modular solutions for the operating room. NEC (Japan) has strengthened its presence in diagnostic and clinical review displays, providing reliable and standards-compliant solutions. Quest International (USA) competes effectively by offering cost-efficient and reliable display solutions. Finally, Siemens Healthineers (Germany) leverages its position as a leading medical device OEM to offer tightly integrated display solutions as part of its broader imaging ecosystem.

Regional Market Dynamics: North America, Europe, Asia-Pacific

The global market is not monolithic. Each major region presents a unique combination of regulatory pressures, economic drivers, and customer preferences that shape the competitive landscape.

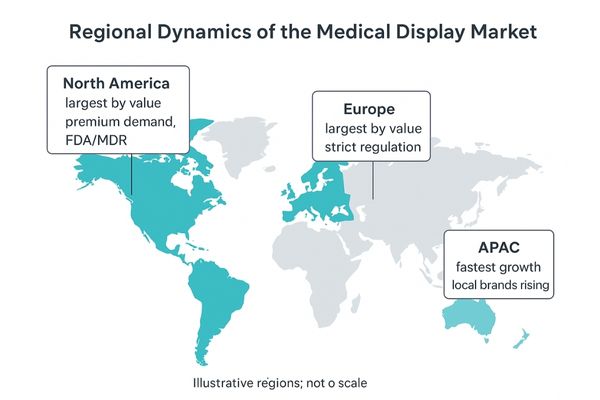

North America and Europe remain dominant, high-end markets, while the Asia-Pacific region is the fastest-growing theater, driven by healthcare infrastructure expansion and the rise of powerful local brands.

A regional analysis reveals distinct market characteristics. North America and Europe continue to be the largest markets by value. Their mature healthcare systems, stringent regulatory oversight by bodies like the FDA and under the CE-MDR framework, and a clinical preference for premium, feature-rich diagnostic solutions create a high-value, high-barrier-to-entry environment. In Europe, the strict requirements of the new Medical Device Regulation (MDR)7 have further raised the compliance threshold, favoring established players with robust quality management systems. In stark contrast, the Asia-Pacific (APAC) region is the engine of global growth. Massive investments in healthcare infrastructure8, particularly in China and India, are fueling tremendous demand for all types of medical imaging equipment. This region is also a hotbed of competition. Local brands like Reshin, FSN Medical, and Jusha are increasingly capturing market share from established global leaders by offering compliant, high-performance alternatives at a more competitive price point and with more agile, localized support. This dynamic is intensifying global competition and forcing multinational manufacturers to refine their pricing, service models, and regional strategies for the APAC market.

Competitive Advantages of Top 10 Manufacturers

Success in this market is not accidental. The leading manufacturers have each cultivated a unique set of competitive advantages that align with specific clinical needs and market segments.

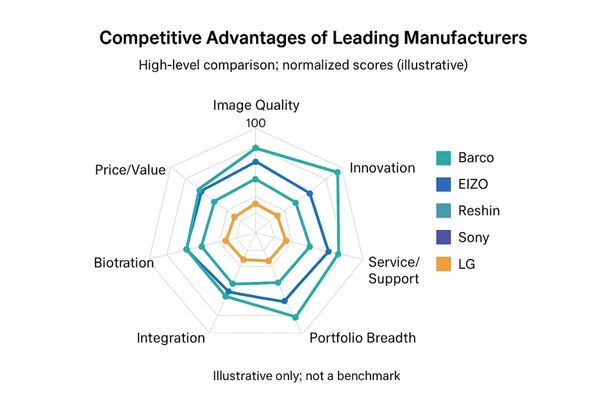

Leading firms differentiate through a combination of imaging quality, systems integration, after-sales support, and targeted innovation, with some focusing on premium niches and others on balancing performance with affordability.

The competitive advantages that define the top 10 manufacturers are diverse and strategically targeted. Premium incumbents like Barco and EIZO build their dominance on a foundation of uncompromising image quality, brand trust built over decades, and deep integration into high-acuity diagnostic workflows like mammography and interventional radiology. Their advantage lies in commanding the high-end market where performance is the primary consideration. In contrast, a company like Reshin has built its competitive edge on balancing high performance with exceptional affordability, disrupting the market by making compliant, high-quality displays accessible to a broader range of institutions. Other players carve out specific niches. Sony and LG leverage their vast R&D capabilities in video technology to produce industry-leading surgical displays with superior color reproduction and 4K clarity. FSN Medical and Advantech differentiate through modularity and customization, offering integrated video routing and display solutions for complex OR environments. NEC and Quest effectively compete on cost-efficiency, providing reliable, certified displays for price-sensitive segments. Finally, Siemens Healthineers employs a systems-level strategy, embedding its displays seamlessly within its broader ecosystem of imaging scanners and software, creating a powerful lock-in effect. For example, Barco and EIZO dominate premium diagnostic imaging, Reshin focuses on high performance-to-cost ratios, while Sony and LG lead in 4K surgical video.

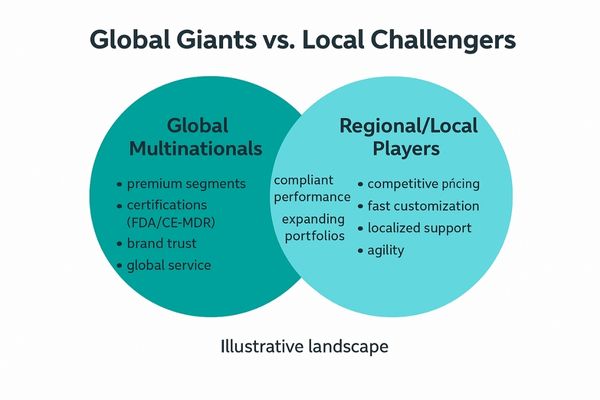

Comparison of Global and Local Players

The medical display industry illustrates a classic market dynamic: the tension between established global giants and agile local challengers. Both play vital, albeit different, roles.

Global leaders excel in premium, certified segments, while local players thrive in cost-sensitive markets by offering faster service and customization, creating a dual-structured competitive landscape.

The structure of the global medical display market9 can be understood as a dual system. On one side are the established multinational leaders. These companies dominate the premium diagnostic and interventional segments, where a long history of reliability, extensive global certifications (FDA, CE-MDR), and strong brand trust are paramount. Their customers are often large, research-focused hospital networks that prioritize cutting-edge technology over cost. On the other side are the dynamic local and regional manufacturers, particularly those based in China and South Korea. These companies thrive in more cost-sensitive markets and segments. Their competitive advantages are agility, speed, and proximity to the customer. They can often provide faster service, more flexible customization options, and a price point that makes advanced medical imaging technology10 accessible to smaller hospitals and clinics. This creates a balanced but fiercely competitive ecosystem. The global players secure the high-end niches, while the local brands drive volume and disrupt traditional pricing models, ultimately pushing the entire industry toward greater efficiency and accessibility.

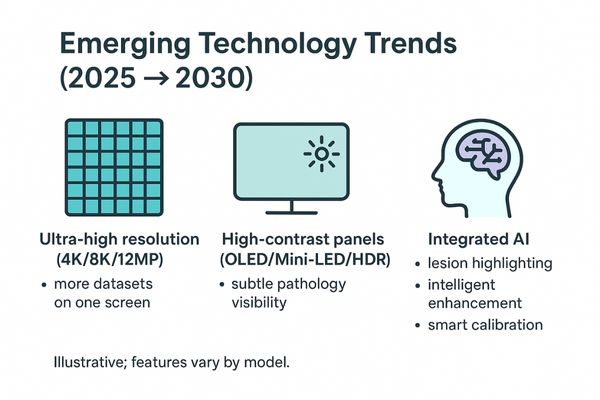

Emerging Technology Trends: 4K/8K, OLED, AI Integration

The technology underlying medical displays is not static. A wave of innovations is currently redefining what is possible in medical imaging, pushing the boundaries of clarity, contrast, and intelligence.

The industry is rapidly adopting ultra-high-resolution 4K/8K displays, superior contrast panels like OLED and Mini-LED, and integrated AI to enhance diagnostic confidence and clinical efficiency.

The future of medical display technology is being actively shaped by three pivotal trends. First is the relentless march toward higher resolution11. While 2MP and 3MP still form the backbone of general radiology, 4K resolution is becoming the standard in surgery, and 8K and even 12MP displays are emerging for complex multi-modality diagnostic workstations, allowing radiologists to view multiple large datasets on a single screen without compromise. Second is the evolution of display panel technology. While high-grade IPS LCD panels remain the workhorse, OLED and Mini-LED backlights are gaining traction. These technologies offer vastly superior contrast ratios, perfect black levels, and faster response times, which can enhance the visibility of subtle pathologies. Third, and perhaps most transformative, is the integration of artificial intelligence12 directly into the display. AI-powered features are moving beyond experimental stages into practical application, enabling functions like automated lesion detection highlighting, intelligent image enhancement, and adaptive brightness controls that optimize the viewing experience and reduce cognitive load. These innovations are collectively setting new benchmarks for performance and functionality.

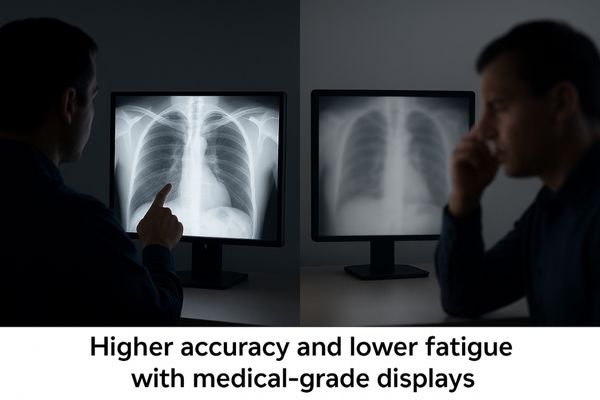

Impact on Clinical Workflows and Diagnostic Accuracy

The choice of display technology is not just an IT decision; it has a direct and measurable impact on the quality of patient care.

Medical-grade displays demonstrably reduce diagnostic errors, accelerate image interpretation, and mitigate the risk of digital eye strain, providing a clear return on investment through improved outcomes and clinician well-being.

The adoption of high-quality, medical-grade displays13 has a profound and positive impact across clinical workflows. In diagnostic imaging, the superior clarity, contrast, and grayscale accuracy of these monitors directly contribute to a reduction in observational errors and false positives. This is particularly crucial in high-stakes fields like mammography and interventional radiology, where a missed detail can have severe consequences. Multiple studies suggest that high-quality medical-grade displays can reduce certain types of observational errors by double-digit percentages, while improving reading speed and consistency. By presenting information clearly and consistently, these displays enable radiologists to interpret studies faster and with greater confidence. In the operating room, surgical displays with 4K resolution and low latency enhance hand-eye coordination and improve the safety of minimally invasive procedures. Beyond accuracy, these displays impact the well-being of clinicians. Features designed to reduce digital eye strain14—such as stable, flicker-free backlights and automatic calibration—help mitigate the physical fatigue associated with long hours of screen time. For hospitals, the return on investment is clear: fewer misdiagnoses lead to better patient outcomes and reduced liability, while faster workflows increase departmental throughput.

Challenges in Standardization and Regulatory Compliance

Despite technological advancements, significant challenges related to standardization and regulation persist, creating complexity for both manufacturers and healthcare providers.

Ensuring consistent DICOM calibration, navigating the high costs of FDA and CE-MDR certification, and addressing uneven adoption in emerging markets remain significant industry-wide challenges.

While the medical display industry is mature, it is not without its challenges. One of the most persistent issues is maintaining consistent DICOM GSDF calibration15 across a diverse fleet of devices within a hospital system. This requires diligent quality assurance and robust calibration tools. For manufacturers, the regulatory burden is immense and growing. Obtaining and maintaining certifications like FDA 510(k) clearance16 and, more recently, the European Union’s stringent Medical Device Regulation (CE-MDR) requires significant investment in quality management systems, rigorous testing, and detailed documentation. These high costs can act as a significant barrier to entry for smaller companies and add to the final price of the product. Furthermore, there is a challenge of uneven adoption globally. While premier academic medical centers in developed nations may standardize on the highest-end displays, hospitals in emerging markets often face budget constraints. This can lead to a gap in clinical capabilities, where less-resourced institutions may continue to use non-compliant or consumer-grade displays for tasks that demand medical-grade precision.

Future Outlook of the Medical-Grade Display Industry

Looking ahead, the medical display industry is poised for continued growth and innovation, driven by the convergence of imaging technology, data analytics, and global healthcare trends.

By 2030, the market is set to exceed USD 3.4 billion, emphasizing AI-enabled smart displays, sustainable manufacturing, and tighter integration with hospital-wide IT platforms, with competition intensifying globally.

The trajectory of the medical-grade display industry points toward a smarter, more integrated, and more competitive future. By 2030, the global market is confidently projected to surpass USD 3.4 billion, with the Asia-Pacific region continuing to be the primary engine of growth. The technological focus will shift from simple visualization to intelligent augmentation. We can expect to see the widespread adoption of AI-enabled “smart displays”17 that can pre-process images, suggest optimal viewing parameters, and seamlessly integrate with diagnostic algorithms. There will also be a growing emphasis on sustainability and green manufacturing practices18, as hospitals become more conscious of their environmental footprint. Integration will deepen, with displays becoming even more tightly woven into PACS, electronic health record (EHR), and telemedicine platforms to create a unified information ecosystem. This technological evolution will take place against a backdrop of intensifying competition. As successful local players continue to scale their operations and expand internationally, and as global leaders push more aggressively into emerging markets, the battle for market share will become more dynamic than ever before, ultimately benefiting healthcare providers with more choice, better technology, and greater value.

Conclusion

The 2025 ranking of medical-grade display manufacturers highlights a dynamic industry led by a mix of established pioneers and innovative challengers, all pushing the boundaries of diagnostic and surgical visualization.

As one of the leading manufacturers in this field, Reshin continues to support hospitals, integrators, and imaging partners worldwide with high-performance medical-grade displays, localized engineering support, and reliable delivery. If you are exploring display solutions for diagnostic imaging, surgery, or OR integration, you are welcome to contact our engineering team directly — we are ready to provide expert guidance for your projects.

📧 Email: info@reshinmonitors.com

🌐 Website: https://reshinmonitors.com/

-

Overview of how innovations in medical-grade displays are enhancing diagnostic accuracy and patient care. ↩

-

Analysis of global medical-grade display market trends and the key players shaping future imaging. ↩

-

Market report outlining size, growth drivers, and forecasts for the medical-grade display segment. ↩

-

Discussion of how telemedicine and remote diagnostics rely on consistent, calibrated displays. ↩

-

Definition of market share and how it reflects a company’s reach and competitiveness. ↩

-

Overview of technological innovation as a source of competitive advantage in healthcare. ↩

-

Detailed explanation of EU MDR requirements relevant to medical display compliance. ↩

-

Insights into healthcare infrastructure trends in APAC and their impact on technology adoption. ↩

-

Global medical display market study covering structure, competition, and future outlook. ↩

-

Review of medical imaging technology developments that are transforming diagnostic practice. ↩

-

Discussion of how higher resolution supports improved diagnostic accuracy and confidence. ↩

-

Examples of AI applications in medical displays and their impact on efficiency and workflow. ↩

-

Explanation of how medical-grade displays differ from consumer screens in diagnostic use. ↩

-

Overview of digital eye strain and strategies to improve visual comfort for clinicians. ↩

-

Technical background on DICOM GSDF calibration and its role in consistent image quality. ↩

-

Summary of FDA 510(k) clearance requirements for medical devices such as diagnostic displays. ↩

-

Discussion of AI-enabled smart displays and their integration into clinical imaging workflows. ↩

-

Insights on sustainability and green manufacturing practices in medical display production. ↩