Entering the medical display market seems lucrative, but it is deceptively complex. New entrants often fail, wasting resources on non-compliant products that hospitals simply will not trust.

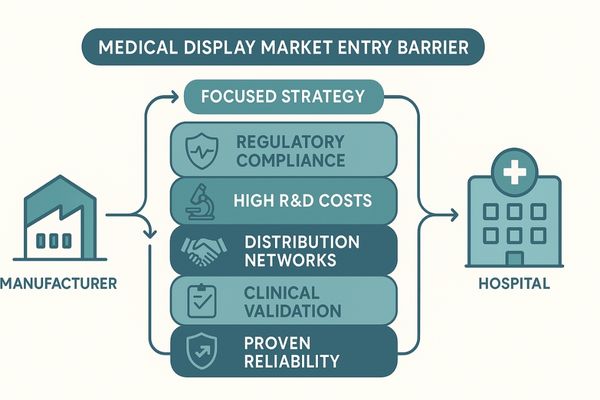

This article explores the significant barriers to entering the medical display market. I will discuss strict regulatory compliance, high R&D costs, entrenched distribution networks, lengthy clinical validation, the need for proven reliability, and how a focused strategy can overcome these challenges.

The medical display sector1 is fundamentally different from the consumer electronics market. A new company cannot simply rebrand a high-quality commercial screen and expect to succeed. The barriers to entry are steep, interwoven, and designed to ensure patient safety and clinical efficacy. These hurdles range from navigating a labyrinth of international regulations to funding capital-intensive research and development. Furthermore, new entrants must build distribution channels and earn the trust of a deeply conservative customer base. Overcoming these challenges requires more than just capital; it demands specialized expertise, patience, and a long-term commitment to quality. For instance, developing a product like the MD120C is a multi-year effort involving not just panel technology but also medical-grade power supplies, proprietary calibration software, and extensive validation. Failure to appreciate this complexity is the primary reason so many new ventures in this space falter.

Strict regulatory compliance requirements limit new market entrants

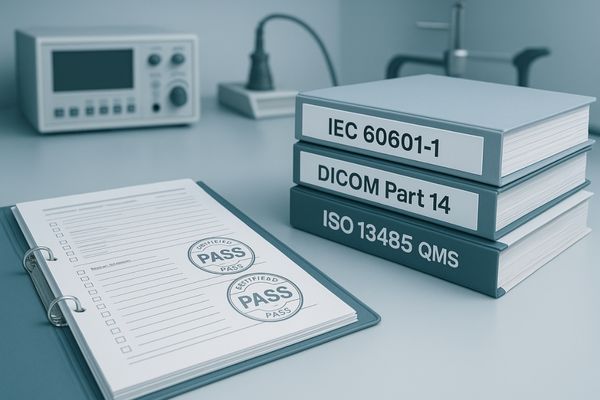

Developing a functional display is one challenge; getting it legally certified is another. Failure to meet critical standards like IEC 60601-1 means a product can never be sold or used in a clinical setting.

Meeting complex medical regulations, including electrical safety (IEC 60601-1) and imaging standards (DICOM), requires immense investment in testing and documentation. This process acts as a significant financial and temporal barrier for new companies.

Navigating the global regulatory landscape is the first and most formidable barrier. Unlike consumer products, medical displays are classified as medical devices and are subject to stringent oversight. The cornerstone is IEC 60601-12, which governs the basic safety and essential performance of medical electrical equipment. Compliance requires specialized engineering in areas like power supply isolation, leakage current, and physical robustness to prevent any risk to patients or operators. Beyond safety, diagnostic displays must adhere to the DICOM Part 143 standard, which ensures consistent grayscale presentation for accurate image interpretation. This is not a simple "setting" but a fundamental aspect of the display’s design, requiring precise factory calibration and software to maintain consistency. Achieving these certifications involves expensive third-party testing, exhaustive documentation, and a quality management system (like ISO 13485). For a product like the MD32C, the certification process represents a substantial portion of its development cost and timeline, effectively filtering out companies unwilling or unable to make this critical investment.

| Regulatory Standard | Primary Focus | Implication for Manufacturers |

|---|---|---|

| IEC 60601-1 | Electrical & Mechanical Safety | Requires medical-grade components and extensive safety testing. |

| DICOM Part 14 | Grayscale Image Consistency | Mandates precise factory calibration and quality control. |

| ISO 13485 | Quality Management System | Demands rigorous process control and documentation for design. |

High R&D costs create barriers to technological innovation

A standard consumer panel cannot meet the demands of a clinical environment. Companies face immense R&D costs to develop medical-grade optics, electronics, and housing materials, making it difficult to compete.

The significant, ongoing investment required for research and development creates a high barrier. This includes custom optics, advanced image processing, and durable, sterilizable materials that are non-negotiable in medical settings.

Technological innovation in the medical display4 field is a capital-intensive endeavor. Unlike the consumer market, which prioritizes aesthetics and mass production, the medical sector demands performance, reliability, and longevity. The R&D costs extend far beyond the LCD panel itself. Significant investment is required to develop proprietary image processing algorithms that reduce latency and enhance detail for surgical applications. Backlight and power supply systems must be engineered for stable, consistent output over tens of thousands of hours, not just a few years. Materials science plays a critical role as well; monitor housings must be constructed from durable, non-porous materials that can withstand repeated cleaning with harsh chemical sterilants without degrading. For example, the design of a surgical monitor5 like the MS275P involves extensive research into anti-reflective coatings and optical bonding processes to improve clarity under bright OR lights. These combined R&D costs create a significant financial moat that protects established companies and makes it incredibly difficult for new, underfunded players to offer a competitive product.

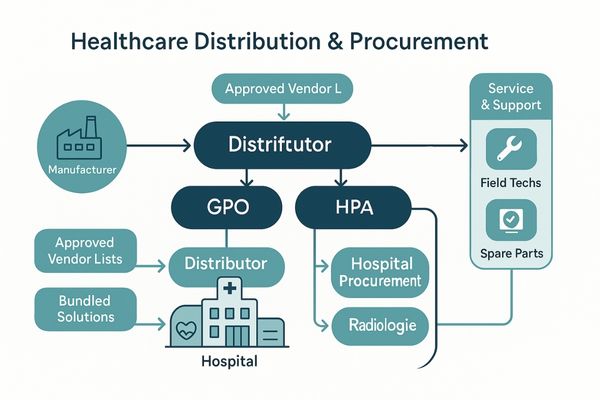

Established brands benefit from strong distribution networks

A great product is useless if it never reaches the hospital. Established brands have deep relationships with distributors and hospital procurement departments, creating a formidable barrier for newcomers.

Incumbent players leverage long-standing distribution channels, service infrastructure, and brand credibility. New companies face the immense challenge of building these hospital relationships and supply chains from the ground up.

Market access in the healthcare sector is controlled by a complex web of relationships. Established brands have spent decades building trust with national distributors, group purchasing organizations (GPOs)6, and the procurement departments of major hospital networks. These channels are not easily penetrated. Distributors are often hesitant to take on a new, unproven brand due to the risks associated with reliability and support. Hospitals, in turn, rely on these distributors and their own approved vendor lists to simplify purchasing and ensure they are buying certified, reliable equipment. A new company must invest heavily in building a direct sales force7 or spend years convincing distributors to carry its product line. This process is slow and expensive. The service and support infrastructure of an established brand, which can guarantee rapid repairs or replacements, is another key advantage. A display like the MS430PC is often sold as part of an integrated OR solution, a sales process that relies entirely on these pre-existing, trusted relationships that a new entrant simply does not have.

Clinical validation demands extend product development timelines

Engineers can test a display in a lab, but its true performance is only revealed in a clinical setting. This validation process is complex, time-consuming, and requires close collaboration with medical institutions.

The need for extensive clinical validation and trials extends product development cycles significantly. This requires securing partnerships with hospitals and surgeons, a time-consuming process that adds complexity and delays market launch.

Before a hospital will invest in a new medical display, it needs proof that the device performs reliably in a real-world clinical environment. This process of clinical validation8 is a major barrier that extends far beyond standard product testing. It requires building partnerships with hospitals and respected surgeons who are willing to evaluate prototype units in actual procedures. This can take months or even years to arrange and execute. During validation, the display’s performance is scrutinized for image quality, usability, durability, and compatibility with existing hospital systems. Feedback from clinical staff is used to refine the product, which can lead to further design and engineering cycles. A diagnostic monitor9 like the MD85CA is not launched until it has been successfully trialed by radiologists across multiple modalities, from CT to MRI. This lengthy and collaborative process is essential for earning credibility, but it represents a significant investment of time and resources that delays revenue generation and can deter companies seeking a quick market entry.

Customer trust relies on proven long-term reliability

In healthcare, equipment failure is not an inconvenience; it can directly impact patient outcomes. Hospitals invest in brands with a proven track record of long-term reliability and support.

Trust is paramount in the medical field and is built on years of proven product reliability. A display failure can disrupt critical workflows and compromise patient safety, making hospitals risk-averse to new, unproven brands.

Trust is the most valuable and hardest-to-win asset in the medical device market10. For a surgeon in a complex operation or a radiologist diagnosing a critical condition, the display is their window to the patient. Any flicker, color shift, or unexpected shutdown can have immediate and serious consequences. Because of this, hospitals and clinicians are inherently conservative. They prefer to purchase from brands that have demonstrated years, or even decades, of dependable performance in the field. This long history creates a "lock-in" effect where credibility becomes a powerful barrier to entry. A new company can present data sheets with impressive specifications, but it cannot present a decade of trouble-free operation in thousands of hospitals. This track record of reliability11 is why a product like the surgical MS270P is trusted; institutions know it is built upon a legacy of dependable performance. A new entrant must slowly build this reputation one successful installation at a time, a process that requires patience and an unwavering commitment to quality.

Reshin leverages expertise and certification to overcome entry challenges

The barriers to entry are significant, but they are not insurmountable. Navigating them requires a deliberate strategy built on technical expertise, regulatory fluency, and strong partnerships.

By combining deep technical expertise in display technology with existing regulatory certifications and established partnerships, we effectively navigate and overcome these formidable market entry barriers, delivering trusted solutions to the market.

Our strategy for succeeding in this market is built on systematically addressing each of these barriers. My background in surgical imaging systems12 provided the foundational technical expertise to lead R&D efforts focused on clinical needs, not consumer trends. We made the strategic decision early on to invest heavily in securing all necessary regulatory certifications13, including IEC 60601-1 and ISO 13485. This created a solid, compliant foundation for our entire product portfolio, including specialized mammography monitors like the MD52G. Rather than trying to build a massive distribution network overnight, we focused on forming strategic partnerships with regional experts who already had trusted relationships with hospitals. We cultivated strong ties with clinical institutions to facilitate validation, using their feedback to create products that solve real-world problems. Most importantly, we committed to a philosophy of long-term reliability. By overcoming these hurdles with a focused, deliberate approach, we have earned the trust of the medical community and established ourselves as a credible player in a challenging market.

| Barrier | Our Overcoming Strategy |

|---|---|

| Regulatory | Proactive investment in full certification (IEC, ISO, etc.) |

| R&D Costs | Focus on specialized medical needs, not broad tech trends |

| Distribution | Building strategic partnerships with trusted regional experts |

| Trust/Reliability | Commitment to long-term quality and clinical validation |

Conclusion

Overcoming the medical display market’s high barriers requires a disciplined strategy centered on regulatory compliance, specialized R&D, and earning clinical trust through proven reliability.

📩 Want to partner with a medical display provider that meets these high standards? Contact Martin at martin@reshinmonitors.com to explore Reshin’s compliant and trusted solutions.

-

Understanding the challenges in the medical display sector can provide insights into industry standards and innovations. ↩

-

Understanding IEC 60601-1 is crucial for anyone involved in medical device manufacturing, ensuring compliance and safety. ↩

-

Exploring DICOM Part 14 will enhance your knowledge of medical imaging standards, vital for accurate diagnostics. ↩

-

Explore this link to understand how medical display technology is evolving and its impact on healthcare. ↩

-

Discover the importance of surgical monitors in improving precision and safety during operations. ↩

-

Understanding GPOs is crucial for navigating healthcare market access and building effective partnerships. ↩

-

Learn strategies for establishing a direct sales force to enhance market penetration and brand trust in healthcare. ↩

-

Understanding clinical validation is crucial for grasping how medical devices are tested in real-world settings, ensuring safety and efficacy. ↩

-

Exploring the benefits of diagnostic monitors can provide insights into their impact on patient care and hospital efficiency. ↩

-

Exploring this resource will provide insights into the evolving landscape of the medical device market, crucial for understanding trust dynamics. ↩

-

This link will help you understand why reliability is essential in medical devices, influencing purchasing decisions in healthcare. ↩

-

Exploring advancements in surgical imaging systems can provide insights into innovative technologies that enhance surgical outcomes. ↩

-

Understanding regulatory certifications is crucial for ensuring compliance and market success in the medical device industry. ↩