Distributors frequently lose hospital tenders despite offering comparable products at competitive prices. Why do some distributors consistently win surgical display and 4K surgical monitor contracts while others struggle to differentiate beyond price point? What hidden evaluation criteria determine tender success?

Winning surgical display tenders for 4K surgical monitors requires moving beyond panel specifications to the real scoring logic. As a Reshin engineer, I help distributors align solutions with clinical workflows, address risk upfront, and use manufacturer expertise so tenders are evaluated on total value, not just unit price.

Surgical visualization technologies represent critical infrastructure for modern operating environments, with hospitals increasingly consolidating procurement through formal tender processes. While specifications sheets appear straightforward, successful distributors recognize that tender outcomes depend on complex scoring methodologies that extend far beyond technical compliance and price points. This article examines proven strategies for improving tender competitiveness through optimized surgical display and 4K surgical monitor solutions1, emphasizing the collaborative partnership between distributors and manufacturers to address the complete spectrum of clinical, technical, and operational requirements.

Understanding how surgical display tenders are really scored

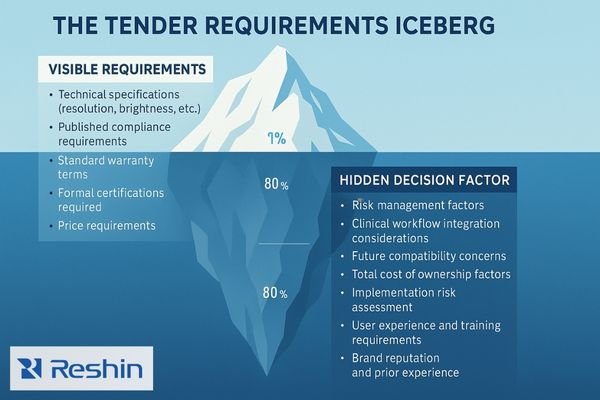

Technical specifications often dominate tender documents, leading distributors to focus primarily on resolution, brightness, and connectivity metrics. Yet these published requirements rarely reveal the underlying scoring framework that determines selection outcomes. What hidden evaluation criteria actually drive purchasing decisions?

In real surgical display tenders, I see that distributors lose not because their specs are weaker, but because they ignore the scoring logic. As a Reshin engineer, I help them map requirements back to hospital risks—image quality, latency, interoperability, compliance and delivery—so they know which items are pass/fail and which can differentiate beyond price.

Decoding Tender Scoring Logic

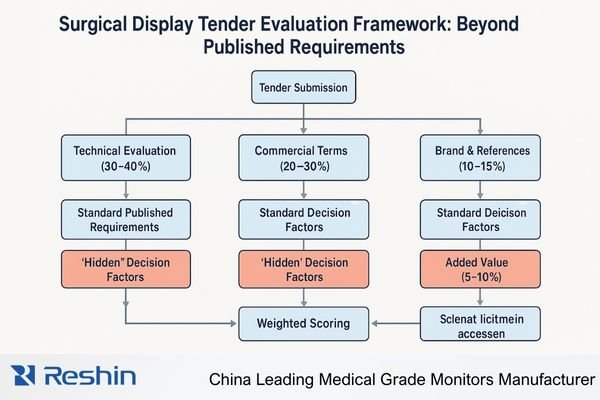

Beneath published requirements lies a complex scoring methodology that allocates points across multiple categories:

- Technical Compliance2: Base-level qualification (typically 30-40% of total score)

- Commercial Terms: Pricing, payment conditions, warranties (typically 20-30%)

- Service & Support: Response times, spare parts, training (typically 15-20%)

- Brand & References: Market presence, installed base, user testimonials (typically 10-15%)

- Added Value: Innovation, future-proofing, special features (typically 5-10%)

The distribution of these weights varies significantly between institutions and often reflects unstated priorities and risk concerns. By analyzing previous tender outcomes and institutional purchasing patterns, distributors can identify which categories receive emphasis in specific healthcare settings. The table below summarizes how these categories typically appear in surgical display and 4K surgical monitor tenders.

| Tender Category | Typical Weight | Hidden Evaluation Criteria | Strategic Response |

|---|---|---|---|

| Clinical Environment | 40-50% | Surgical workflow support, Image quality under OR lighting, Sterilization protocols | Demonstrate clinical workflow integration, Provide clinical reference sites |

| Technical Infrastructure | 25-35% | Compatibility with existing systems, Signal management, IT integration | Document interface compatibility, Propose simplified integration pathways |

| Financial & Operational | 15-25% | Total cost of ownership, Maintenance requirements, Staff training needs | Present lifecycle cost analysis, Highlight ease of maintenance |

| Risk Management | 10-15% | Regulatory compliance, Supply chain reliability, Manufacturer stability | Provide comprehensive compliance documentation, Explain manufacturer capabilities |

Identifying Unstated Requirements

Beyond the explicit scoring categories, successful tender responses address unstated institutional concerns:

- Clinical Risk Management: How the solution prevents visualization failures during procedures

- Workflow Efficiency: How the displays integrate with existing surgical processes and staff movement

- Future Compatibility: How the system will accommodate emerging imaging technologies

- Standardization Benefits: How the proposal supports institution-wide standardization initiatives

By systematically mapping both explicit requirements and unstated priorities, distributors can transform generic product offerings into tailored solutions that address the complete spectrum of institutional concerns. In my experience, this alone often moves a proposal from “one of many compliant bids” to a clearly differentiated, lower-risk choice in the eyes of the evaluation committee.

How should distributors position value beyond panel specifications?

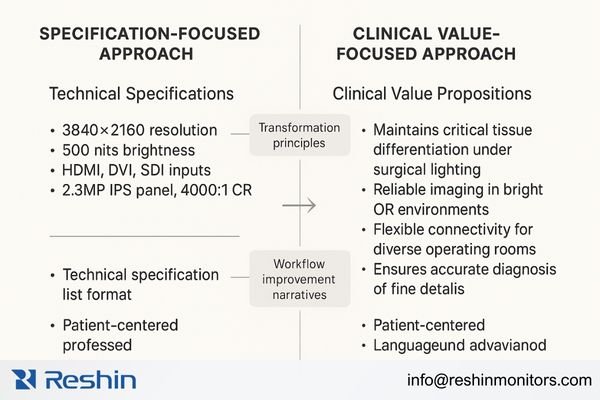

Technical datasheets dominate most tender submissions, yet procurement committees increasingly make decisions based on broader value considerations. How can distributors transform technical specifications into compelling clinical and operational value narratives?

When I review tender drafts with distributors, I often see pages of panel specs but almost no link to clinical value. My advice is simple: every key specification must answer a clinical or operational “so what?”—how it helps surgeons see better, staff work safer, or the hospital reduce risk and lifecycle cost.

Translating Specifications to Clinical Outcomes

Successful value positioning begins by reframing technical specifications in terms of their direct clinical impact3:

-

Instead of: "3840×2160 resolution with 500 nits brightness"

Position as: "Maintains critical tissue differentiation even under high-intensity surgical lighting, allowing surgeons to distinguish vital structures at typical operating distances" -

Instead of: "Multiple 12G-SDI, HDMI 2.0, and DisplayPort inputs"

Position as: "Seamlessly integrates with all departmental imaging sources without requiring staff to manage complex connection changes during procedures" -

Instead of: "IP65-rated front panel"

Position as: "Enables rapid between-case cleaning without risk of liquid ingress, reducing room turnover time while maintaining infection control standards"

This translation process should be applied systematically across all key specifications, creating a narrative that connects technical capabilities directly to clinical and operational benefits that procurement decision-makers can readily evaluate. When distributors consistently write in this language, technical review meetings shift from debating numbers to discussing how the proposed 4K surgical monitors will actually support daily practice in the OR.

Structuring Value-Based Proposals

Beyond individual specification translation, the overall proposal structure should reflect clinical workflows rather than technical categories:

- Procedure Support: How the display solution enhances specific surgical procedures

- Team Visualization: How the system supports collaborative viewing among surgical team members

- Workflow Integration: How the displays integrate with existing clinical processes

- Risk Mitigation: How the solution addresses potential failure modes and clinical risks

- Future Adaptability: How the system will accommodate evolving clinical requirements

By organizing the proposal around these clinical categories rather than technical specifications, distributors create documents that procurement committees can evaluate in terms of institutional priorities rather than isolated product features. This approach naturally elevates the conversation from price comparison to value assessment, allowing premium solutions to compete effectively even against lower-priced alternatives. In practice, I find that once a committee sees a clear link from features to outcomes, they are much more willing to assign higher technical scores and accept moderate price differences.

Engineering surgical display solutions around typical tender scenarios

Most tender responses treat each hospital requirement as a unique case, creating inefficient proposal processes and inconsistent solution designs. How can distributors develop standardized solution frameworks that both streamline proposal development and improve technical scoring?

On the engineering side, I rarely design surgical display solutions “from scratch” for every tender. Instead, I group requirements into a few recurring scenarios—standard OR, hybrid OR, endoscopy, day surgery, teaching—and then adapt proven solution stacks for each. Distributors who reuse tested architectures usually score higher on standardization, safety and expandability.

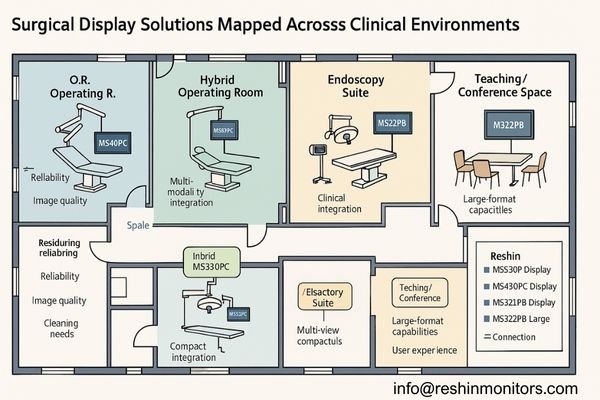

Scenario-Based Solution Architecture

Effective tender responses begin by categorizing clinical environments into standardized scenarios with defined requirements:

-

Standard Operating Rooms

- Primary focus: Reliability, image quality, cleaning protocols

- Typical configuration: Primary surgical display (31.5"-32") with secondary reference monitors

- Key considerations: Boom mounting constraints, team visibility, ambient lighting conditions

-

Hybrid Operating Environments4

- Primary focus: Multi-modality integration, large field viewing, advanced routing

- Typical configuration: Large primary displays (43"-55") with multiple auxiliary screens

- Key considerations: Multiple imaging sources, viewing distances, team collaboration

-

Endoscopy/Minimally Invasive Suites

- Primary focus: Color accuracy, latency minimization, compact integration

- Typical configuration: Near-field primary displays with precision color management

- Key considerations: Boom/cart mounting options, cable management, specialized color profiles

-

Teaching and Conference Environments

- Primary focus: Large-format viewing, multi-source display, remote observation

- Typical configuration: Large-format displays (55"+) with multi-view capabilities

- Key considerations: Viewing distances, audience size, remote connectivity options

Building Solution Stacks

For each scenario, develop standardized solution stacks that address the complete visualization environment:

- Primary Surgical Displays: Direct operative field visualization

- Secondary Clinical Displays: Reference imaging, vital signs, PACS integration

- Teaching/Observation Displays: Staff education, remote consultation

- Control and Routing Infrastructure: Signal management, source selection, backup systems

These solution stacks should emphasize systematic integration rather than isolated product selection, highlighting how components work together to create cohesive visualization environments. By developing standardized stacks for common scenarios, distributors can rapidly configure tailored solutions for specific tender requirements while maintaining consistent architecture and performance characteristics.

The scenario-based approach provides multiple advantages in tender responses: it demonstrates a strong understanding of different clinical environments, makes it easier to justify model choices for each space, and shows the hospital that expansion or renovation can reuse the same 4K surgical monitor architecture. Over time, this also reduces engineering effort for distributors, because each new tender becomes a variation on a well-tested template rather than a completely new design.

Building presales collaboration between distributors and Reshin engineering teams

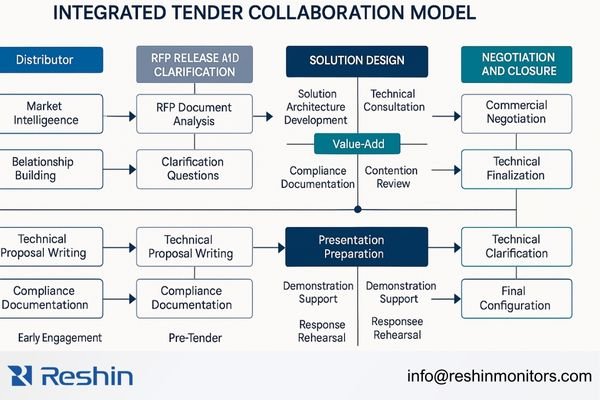

Many distributors approach manufacturers only after receiving tender documents, missing critical opportunities to shape requirements and develop differentiated solutions. How can distributors leverage manufacturer engineering expertise throughout the complete tender lifecycle to improve competitive positioning?

When distributors only send me a nearly finished tender response to “check the specs”, most optimization opportunities are already gone. The best results come when we collaborate from the start—reading the RFP together, shaping clarification questions, and co-designing OR layouts—so the final surgical display solution is clearly differentiated before pricing is even discussed.

Establishing Collaborative Workflows

Effective presales collaboration requires structured engagement throughout the tender lifecycle:

-

Pre-Tender Phase

- Joint market intelligence gathering

- Early specification influence activities

- Relationship development with key stakeholders

- Preparation of reference materials and case studies

-

RFP Clarification Phase

- Collaborative tender document analysis5

- Development of clarification questions

- Technical requirement interpretation

- Competitive positioning strategy development

-

Response Development Phase

- Solution architecture design

- Technical writing support and review

- Compliance documentation preparation

- Presentation material development

-

Post-Submission Support

- Technical presentation preparation

- Question response development

- Sample/demonstration coordination

- Final negotiation support

Leveraging Manufacturer Expertise

Manufacturer engineering teams provide valuable resources that extend beyond product specifications:

- Clinical Application Knowledge: Understanding of how products perform in specific surgical contexts

- Technical Integration Expertise: Experience with various hospital infrastructures and integration challenges

- Compliance Documentation: Comprehensive regulatory and certification documentation

- Visualization System Design: Holistic approach to imaging chain optimization

- Competitive Intelligence: Understanding of alternative solutions and their limitations

By systematically incorporating these resources into the tender process, distributors create responses that reflect deeper technical understanding and more comprehensive solution design. This collaborative approach also demonstrates to procurement committees that the distributor has strong manufacturer support, reducing perceived implementation risk. In many of my projects, this visible partnership is exactly what reassures hospitals that the proposed 4K surgical monitor solution will be delivered and supported reliably over its full lifecycle.

Reshin 4K surgical display portfolio for tender differentiation

Product portfolios often appear as simple catalogs of specifications, limiting differentiation opportunities in competitive tenders. In contrast, Reshin positions its surgical display portfolio as an engineered platform for OR visualization: a China-based manufacturer focused on medical-grade 4K surgical monitors, long-term OR integration projects, and close collaboration with distributors across China, APAC and other international markets. The question for tender work is not just “which screen fits the spec”, but how to use this portfolio to build a coherent, scored solution for each hospital environment.

When I support tender projects with Reshin displays, I treat the product line as a toolbox rather than a static catalog. MS550P, MS430PC, MS321PB and MS322PB are each designed with specific OR roles in mind, so distributors can design zone-based solutions where every 4K surgical monitor is justified by clinical use, signal architecture and workflow, not just by screen size. This makes it much easier to explain to evaluation committees why each model was selected and how the complete system will perform in daily practice.

Strategic Portfolio Architecture

The Reshin surgical display portfolio is designed around a structured architecture that supports systematic solution design across diverse clinical environments. The overview below helps distributors map each model to typical tender roles, OR zones and clinical use cases, turning a simple product list into a clear, role-based visualization strategy.

| Model | Size | Primary Application | Key Differentiators | Clinical Value Proposition |

|---|---|---|---|---|

| MS550P | 55" | Primary display for hybrid ORs, Teaching theaters, Multi-disciplinary viewing | Multi-view layouts, high-bandwidth digital connectivity (exact interface set: Pending Confirmation), AR-coated front glass | Enables collaborative team viewing with consistent image quality across wide viewing angles, supporting complex hybrid procedures with multiple imaging modalities |

| MS430PC | 43" | Standard ORs, Secondary viewing positions, Wall-mounted applications | Compact form factor, optimized for HDMI/DP signals from integrated routing systems | Provides ideal viewing experience at intermediate distances typical in standard ORs, balancing screen size with mounting flexibility and installation constraints |

| MS321PB | 31.5" | Primary surgical viewing, Boom-mounted applications, Endoscopic procedures | High pixel density, anti-reflective fully bonded front glass, multiple digital inputs | Delivers precise detail visualization at typical surgeon working distances, with optical performance tuned for strong surgical lighting conditions |

| MS322PB | 32" | Space-constrained ORs, Mobile cart applications, Near-field viewing | Enhanced reflection control, support for high-bandwidth SDI connectivity (details: Pending Confirmation), compact mounting options | Supports flexible deployment in space-limited environments while maintaining full 4K resolution and comprehensive connectivity options |

Solution Design Methodology

Effective tender responses leverage this portfolio through a systematic design process:

-

Clinical Environment Analysis: Identify specific procedural requirements, physical constraints, and workflow patterns for each area covered by the tender

-

Display Role Definition: Categorize required displays by function within each environment:

- Primary surgical visualization

- Reference/ancillary imaging

- Team/teaching observation

- Control room/technical monitoring

-

Model Selection and Justification: Match appropriate models to each defined role based on:

- Viewing distance and angle requirements

- Installation constraints and mounting options

- Interface requirements and signal sources

- Special environmental considerations

-

System-Level Integration: Document how selected models work together to create a cohesive visualization environment:

- Consistent color calibration across displays

- Standardized interface configurations

- Unified control mechanisms

- Coherent maintenance protocols

This structured approach transforms individual product selection into comprehensive solution architecture, highlighting how the complete display ecosystem addresses the institution’s clinical and operational requirements. When distributors present MS550P, MS430PC, MS321PB and MS322PB in this way, evaluation committees see a balanced, scalable 4K surgical monitor strategy rather than a loose collection of screens with similar specifications.

Conclusion

As a Reshin engineer working with distributors on surgical visualization projects, I see that the most competitive tender responses have one common trait: they treat surgical displays and 4K surgical monitors as part of an engineered system, not as standalone products. By understanding real scoring logic, telling clear clinical value stories, reusing proven solution scenarios, collaborating closely with manufacturer engineers, and mapping each Reshin model to a defined role in the OR, distributors can compete on solution quality and risk control instead of fighting purely on price.

For distributors who want to strengthen their next surgical display or 4K surgical monitor tender, our team at Reshin can work alongside you from early requirement analysis through solution design and technical writing, helping you build responses that are both clinically convincing and technically robust.

✉️ info@reshinmonitors.com

🌐 https://reshinmonitors.com/

-

Discover the advantages of 4K surgical monitor solutions for improved clarity and precision in surgical procedures. ↩

-

Understanding Technical Compliance is crucial for grasping how scores are allocated in tenders, impacting your strategy. ↩

-

Understanding clinical impact helps in crafting compelling narratives that resonate with healthcare professionals. ↩

-

Discover how hybrid environments integrate multiple modalities for improved surgical outcomes and collaboration. ↩

-

Explore this resource to enhance your understanding of effective collaboration in tender processes. ↩